Kroger and Albertsons: A Case Study in Operational Resilience

More Operational Coverage

The latest twist in the Kroger-Albertsons merger saga is fueling more uncertainty about whether this deal will ever get done.

On July 25, the retailers and the state of Colorado all agreed to an order to again delay the proposed $24.6 billion merger between The Kroger Co. and Albertsons Cos. The order grants a temporary injunction, and Kroger and Albertsons now must wait until a September trial to see whether they can move forward with their plans to merge.

But CEO Rodney McMullen says that no matter what happens with the merger — or the economy or the consumer, for that matter — Kroger’s strategy remains the same: solving problems for customers.

“When we work to solve “what’s for dinner?” for our customers, we don’t think about “the grocery industry” … we think about how to make meals easier, fresher and more affordable,” McMullen said. “When meals are a problem to solve, families come to Kroger for the answer. When people think food, we want them to think Kroger.”

Racked by Delays

Since Cincinnati-based Kroger, which has annual revenue of $150 billion and more than 414,000 associates, revealed plans to merge with Boise, Idaho-based Albertsons in October 2022, federal and state lawsuits have piled up, on top of attacks from unions, the media and anyone who loves to shop at grocery stores. The lawsuits are in various stages of litigation, and the bad press for Kroger has been relentless. It’s a bad time to be a couple of unionized supermarket chains trying to merge so as to compete with non-union grocery giants such as Walmart and Costco.

Meanwhile, consumers are feeling squeezed by inflationary grocery prices and the Federal Trade Commission (FTC) is eager to fight any move by retailers that might be seen as anti-competitive.

“While we firmly believe Kroger offers the best products at the best prices, we acknowledge both Walmart and Amazon have clear advantages,” McMullen told the U.S. Senate when he appeared before the Subcommittee on Competition Policy, Antitrust and Consumer Rights on Nov. 29, 2022, to testify about the merger. “Our combination with Albertsons will allow us to more effectively compete against non-union retailers, from Amazon and Walmart to Costco and ALDI. The customer reach, as well as digital and technology capabilities, we expect to gain through this merger will enable us to provide an enhanced seamless shopping experience, both in store and online. We will have an expanded network of stores and distribution centers, and a broader supplier base allowing us to deliver fresher food faster to more customers. Albertsons’ portfolio will expand our core supermarket, fuel and pharmacy businesses, bolstering our ability to drive additional traffic into stores and digital channels, which in turn provides even more value to our customers.”

Kroger, which operates around 2,750 stores, has been doing everything that it can to assuage fears of the public and the FTC that a combined company with Albertsons, which operates around 2,300 stores, might turn into a monopoly.

On July 9, Kroger released a list of the stores, distribution centers and plant locations that it plans to divest to Keene, N.H.-based C&S Wholesale Grocers should the merger be completed. Some 579 Kroger and Albertsons stores, as well as other assets, will be divested as part of the plan, and Kroger has begun the process of informing associates at those locations of the move. It’s unclear whether additional divestitures will be required to get the deal done. There’s a more important narrative underpinning this story, however, and that’s whether traditional grocery retailers will be allowed to compete fairly against an increasingly fragmented grocery channel dominated by non-union players.

For now, McMullen says that his company is focused on what it does best: maximizing value for a strained U.S. shopper.

“Kroger is in the meal solution business, and we know many families feel overwhelmed and are looking for help,” he notes. “Their budgets are stretched, and the activities of daily life create full and complicated schedules. Often deciding ‘what’s for dinner tonight’ just feels like one more problem to solve. And families have endless ways to solve this problem — from restaurant takeout to meal delivery to buying ingredients and cooking together.”

Lower Prices, More Products

To that end, the retailer unveiled an amended divestiture plan in April detailing how its merger with Albertsons will result in lower prices. The company committed to investing $500 million to begin lowering prices on day one post-close. This commitment builds on Kroger’s track record of reducing prices every year, with $5 billion invested to lower prices since 2003.

“Our strategy is centered around providing solutions for our customers, no matter the economic environment,” McMullen says. “To minimize the impacts of ongoing economic uncertainty, we are keeping our prices low — this is the foundation of our strategy. Plainly and simply, lower prices attract more loyal customers who help us grow our business. This allows us to reinvest in even lower prices, an ever-improving shopping experience and higher wages [Kroger’s average hourly rate is nearly $19, or nearly $25 with comprehensive benefits. This represents a 33% increase in rate in the past five years.]. We know this model works, because we have been using it successfully for many years.”

According to the retailer, customers will also have access to more favorite items from their own communities, as Kroger has committed to increasing the number of local products in its stores by 10% post-close. The company is additionally committed to expanding its already top-selling array of 12,600 private-brand products generating around $31 billion in revenue annually.

“The Our Brands team is taking a fresh approach to their work,” McMullen explains. “With 800 new products coming to our shelves this year alone, even picky eaters can find a new item they will love. From our organic Simple Truth options and indulgent Private Selection products to the ever-popular Kroger brand choices and budget-conscious Smart Way line, we offer inflation-resistant items that continue to earn their place on our customers’ dinner tables.”

Last year, Kroger launched Kroger Mercado, a Hispanic-inspired brand offering more than 50 products, including such items as fresh meat, beverages, snacks, sides and desserts.

“We are seeing customers who are more interested in exploring new flavors than ever before, which makes the Our Brands work so exciting,” McMullen observes. “This renewed interest in international flavors prompted us to launch our new Hispanic-inspired Mercado brand. It features authentic products that fit into any budget. This is just one example of the innovation that makes Our Brands products so special.”

Restock Kroger (Cont’d)

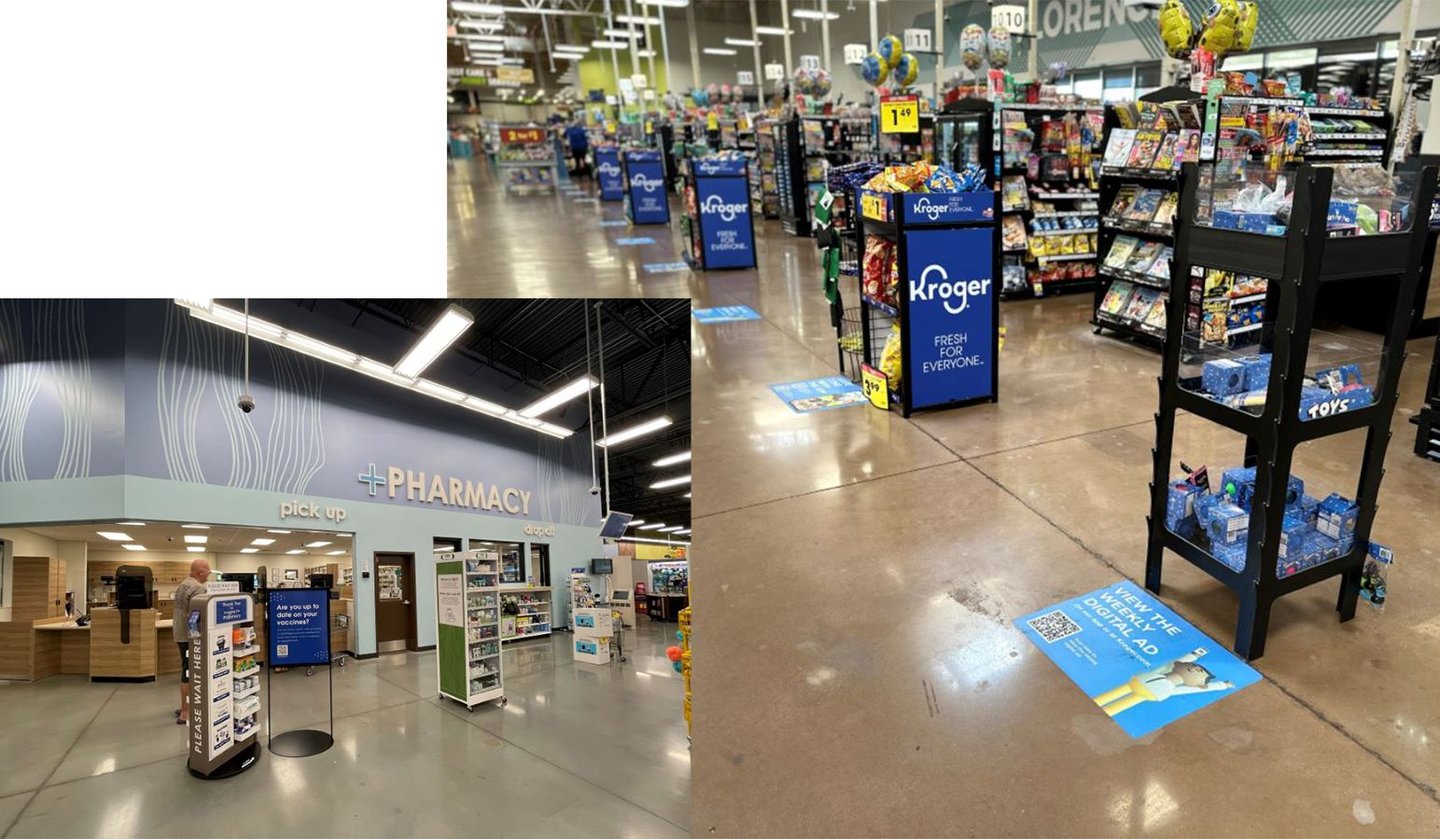

Kroger is in year seven of its “Restock Kroger” transformation initiative, which it says has improved processes, created new revenue streams, and freed resources to invest in associates, technology and lower prices. The initiative has also removed $3 billion in costs from the business.

So where does Restock Kroger stand now?

“As part of our capital investment plans for 2024, we announced that we are building more new stores in a meaningful way that will support our long-term growth model,” McMullen says. “When we launched Restock Kroger, we knew that a strong omnichannel experience was a key to serving our customers in the future. We are pleased with the progress we’ve made there and will continue to invest in digital, as it remains an important part of our growth model.”

In its earnings report for the first quarter ended in June, Kroger logged growth in digital sales, increased total household penetration and touted its better-than-expected performance. However, its net income dipped for the first time in 12 months. The retailer said when it released the report that same-store sales were flat and that earnings had dropped 1.6% to $947 million, compared with the prior year.

According to Kroger, the decreases were attributable to increased price investments and lower pharmacy margins, but McMullen stresses that the company continues to be bullish on its health- and-wellness business.

“Our Kroger Health business continues to grow and support families who want to live healthier lives,” he asserts. “Our pharmacists, techs, dietitians and nurse practitioners are available to patients every day to address big and small health needs. From dietary counseling to questions about medications, patients can find expert, convenient care right in their neighborhood store. We are optimistic about the potential of this area of our business. Our [prescription] adherence initiatives are on track, and our teams are providing excellent care, which helps patients live healthier lives. Additionally, our marketing plans and in-store activations designed to raise awareness and attract new patients are launching now to help drive growth in the back half of the year.”

Digital sales overall grew more than 8% during the quarter, and Kroger’s delivery and pickup business combined for double-digit growth. During Q1, Kroger increased delivery sales by 17% over last year, and also grew digitally engaged households by 9%. Additionally, the grocer achieved a new record for quarterly pickup fill rate.

[Never miss a story – sign up for Progressive Grocer's FREE Daily newsletter]

The growth in digital came at a time when Kroger had paused some of its digital delivery plans, specifically with its partner Ocado. In 2018, Kroger revealed a partnership with the U.K.-based grocery tech business to launch more than 20 customer fulfillment centers (CFCs) across the United States, but then put a hold on some of those openings. Now the retailer, which has opened only eight CFCs so far, seems to be fine-tuning its delivery strategy with new offerings from Ocado.

In late July, Ocado said that Kroger had placed an order for new automated technologies to roll out in CFCs across its network. The technologies include proprietary Ocado innovations such as On-Grid Robotic Pick (OGRP) and Automated Frameload (AFL), both of which aim to bring new levels of efficiency and labor productivity to the Kroger Delivery network. These innovations will enable Kroger to further drive down its costs to fulfill orders from CFCs.

As for brick and mortar, McMullen says that expanding the store network is important to increasing overall omni sales.

“We believe a strong and growing store network is important,” he notes. “Many of the ways we go to market in digital still come through the store channel. We know that our most profitable customers shop both in-store and online, so it’s important to be there for our customers in the way they choose to shop with us. As a result, we expect new stores to be an important part of sales growth in our [total shareholder return] model going forward.”

Customers for Life (Cont’d)

Meanwhile, Albertsons is moving along on its own transformation path, which it calls Customers for Life. Launched in 2022, the five-pronged strategy is designed to place the customer at the center of everything that Albertsons does, with the ultimate goal of supporting customers every day, every week and for a lifetime.

At the Western Association of Food Chains convention in Denver this past May, Gineal Davidson, SVP of national merchandising at Albertsons, summed the strategy up this way: “Our purpose remains simple: bringing people together around the joys of food and inspiring well-being through food that supports traditions through innovative and fresh food, through flavors and functional products that we collectively bring to market to build up our families and communities.”

Davidson and a slew of other Albertsons senior leaders detailed at the show how the company is driving its “ambition of creating customers for life by connecting with and supporting customers in all stages of their life.”

When Albertsons debuted the strategy, the retailer defined it as digitally connecting and engaging customers; differentiating the store experience; elevating the retailer’s distinctiveness in fresh by expanding private-brand products and services, as well as by enhancing product offerings in center store; modernizing capabilities through an improved supply chain, enhanced data and data analytics, and ongoing productivity; and further embedding environmental, social and governance (ESG) initiatives throughout its operations.

Davidson went further, though, by explaining how the company is working to create distinction in the minds of customers by making their lives easier through convenience, quality, health, value and personalization.

“We’re creating compelling reasons for customers to interact with us daily, not only to shop, but to engage with us,” Davidson observed. “We want to help them plan their meals, find new recipes, support their routines in a very easy way and find information that inspires them.”

Davidson explained that the keys to success for Albertsons this year include thinking more deeply about the insights and information that the retailer has about customers, “and about the customers that we don’t get and about tomorrow’s customers, so that we can drive more trips and traffic, sign up new members, retain our current members, increase the breadth and depth of our categories, and continue to grow our share of wallet in the market. … We want to build emotional connections, personalized and relevant communications, delightful and rewarding experiences, meaningful brand connections.”

Albertsons for U

When Albertsons, which has annual sales of around $80 billion and more than 285,000 associates, reported first-quarter earnings this past July, one metric in particular was a highlight: Loyalty members increased 15% to 41.4 million during the period.

CEO Vivek Sankaran credited the Customers for Life strategy with the increase. “In the first quarter of fiscal 2024, we continued to invest in our Customers for Life strategy and the digital and omnichannel capabilities necessary to support it,” Sankaran said. “Our Customers for Life strategy is placing the customer at the center of everything we do, and we continued to drive strong year-over-year growth in loyalty members as we launched our new simplified for U loyalty program.” Earlier this year, the retailer transitioned its loyalty program to a single points-based system and added a new automatic cash-off option for more convenient savings and other benefits.

Sankaran also pointed out that amid an evolving economic and industry backdrop in Q1, Albertsons continued to deliver outsized growth in its digital and pharmacy businesses.

The company reported that its Q1 net sales and other revenue came to $24.3 billion, compared with $24.1 billion during Q1 2023. The increase was driven by Albertsons’ 1.4% growth in same-store sales, along with strong growth in pharmacy sales.

Net income dropped to $240.7 million, or 41 cents per share, however. Last year’s net income was $417.2 million, or 72 cents per share, which included the $49.7 million, or 9-cent-per-share, benefit related to the reduction in the reserve for an uncertain tax position.

During Q1, the company completed 17 remodels, opened one new store, and invested in digital and technology platforms. Albertsons sees challenges ahead, though.

“As we look ahead to the balance of fiscal 2024, we expect to see headwinds related to investments in associate wages and benefits, an increasing mix of our pharmacy and digital businesses which carry lower margins, and the cycling of prior-year food inflation,” Sankaran said. “We expect these headwinds to be partially offset by ongoing productivity initiatives.”

In addition to those factors, uncertainties regarding macroeconomic conditions, employee morale, consumer behavior and, of course, the merger with Kroger are sure to pose extra difficulties.