2020 Retail Meat Review: Robust Sales With Plant-Based Products Gaining Ground

Despite the growth of plant-based alternatives, grocery retailers are still bullish on animal proteins.

And that confidence appears to be growing, according to the results of Progressive Grocer’s exclusive survey of supermarket operators.

Nearly half (48%) of retailers responding to PG’s survey said that their meat sales rose during 2019, up from 42% a year ago. In a sign that the economy has improved for consumers, only 9% of respondents told us that their meat sales declined in the past year, compared with 27% the year prior.

For 2020, 66% of retailers responding to the survey say that they anticipate their meat sales to increase this year, with the rest expecting sales to remain constant and none predicting a decrease.

Kent Horejsi, meat manager and buyer for El Rancho Market, in Pismo Beach, Calif., says that his store’s meat sales are projected to grow by 5% in 2020.

‘We are attracting growth with all-natural, humanely raised, sustainability practices, non-GMO, no antibiotics, no-hormones-ever partners,” Horejsi tells PG. “We’re educating the public on new cuts, cooking methods and maintaining center plate.”

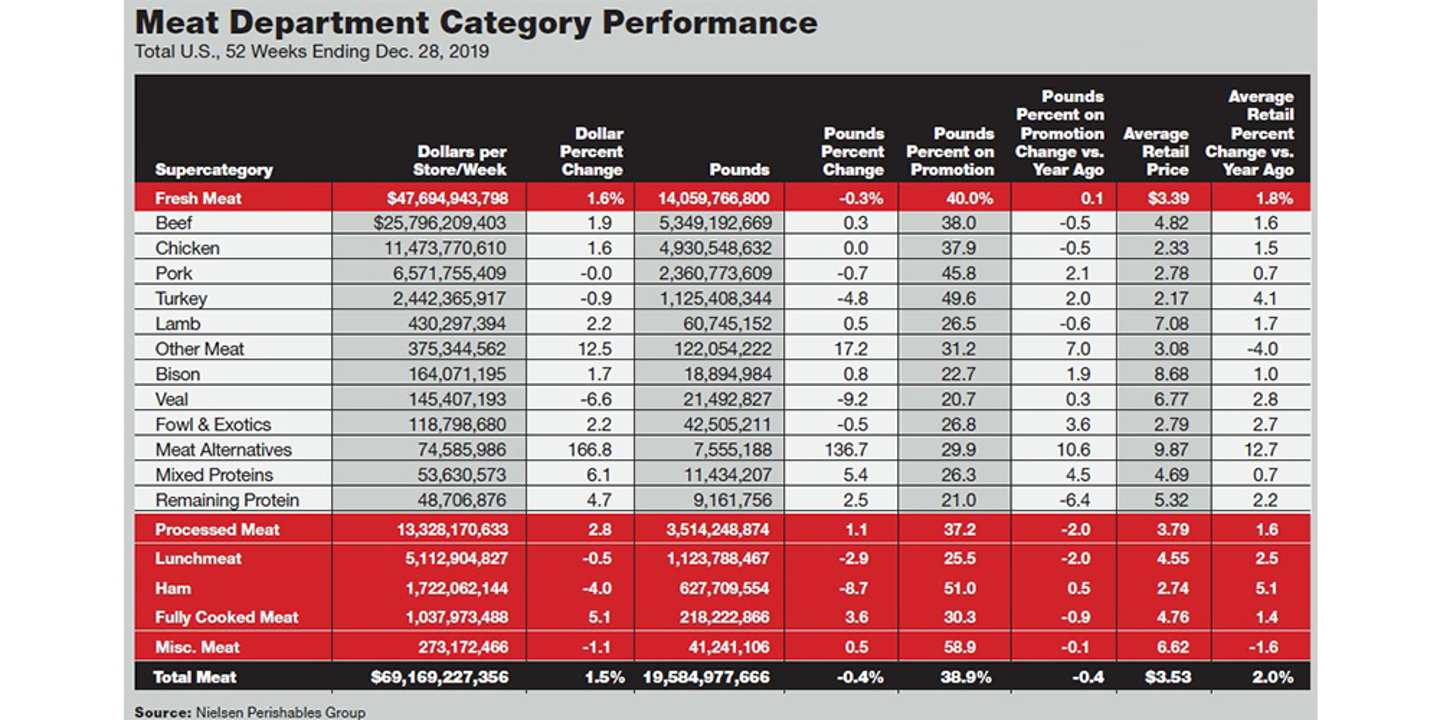

From a topline perspective, meat was fairly stable in 2019, with moderate dollar growth (1.5%) driven by price increases (2%), says Meagan Nelson, associate director at New York-based Nielsen. “But as you dive deeper, there are shifts.”

One of the most notable: the decline in hams overall, with a 4% drop in dollars and nearly 9% in pounds. “What was interesting in 2019 was the growth in more processed meat, with fully cooked up 5.1% and 2.8% in processed meat,” Nelson notes. “However, fresh meat is still the main driver of the meat department, making up 69% of sales, and had moderate growth.”

Of the four key proteins, beef and chicken held strong, with growth in dollars, and beef seeing growth in pounds (chicken pounds were flat), Nielsen reports. Both pork and turkey saw a slip in pounds from 2018, with turkey down 4.8%.

Trending health benefits may be contributing to the boost in beef. According to Nielsen’s “How America Will Eat” report, released last December, fresh beef ranks fourth on the list of “top brain foods” considered beneficial to anxiety, depression, brain function and sleep, with 6% growth on sales of $919 million for the year ending Sept. 28, 2019.

To be sure, beef ranks prominently among products that have seen increased demand in the past year. More than half (55%) of PG survey respondents report higher sales of premium-brand beef, 57% report selling more grass-fed beef, and 16% report selling more dry-aged beef.

And despite the growth in plant-based meat alternatives being driven by younger consumers, Millennial eating habits are most influenced by practical needs, including stress (30% versus 23% for Gen X, 15% for Baby Boomers and 9% for the Greatest Generation) and mental health benefits (10% Millennials, 5% Gen X, 3% Boomers, 2% Greatest Gen), according to Nielsen’s Homescan U.S. survey of 19,988 consumers in July 2019.

Manufacturers and retailers also have an opportunity to promote the price efficiency of certain fresh meats as healthy protein options, Nielsen advises. “Where trendy and convenient protein sources like jerky (25 cents per gram), nutrition bars (20 cents per gram) and nuts (13 cents per gram) suit on-the-go consumers, they are sold at six to 12 times the price per gram of chicken, pork and turkey (2 cents per gram, respectively),” the report says.

“For the 55% of Americans who prioritize high-protein content when deciding what to buy, this message of protein price accessibility could draw renewed attention to traditional meat-based goods.”

Meanwhile, convenience is also driving sales, as half of survey respondents report a boost in sales of smaller portions or pack sizes, and 68% say that they’ve sold more value-added items like seasoned and marinated meats.

Retailers also report that promotions like mix-and-match bundles and cross merchandising within the store have been effective in driving meat sales.

Planting Their Flag

Plant-based meat alternatives continue to make inroads into the meat department as retailers respond to the growing interest in, and demand for, these products.

Among survey respondents, 77% carry plant-based meats, up from 46% a year ago, and 67% merchandise them in the meat department alongside traditional animal proteins. Nearly 60% report that they’ve been carrying plant-based meats for less than a year, with a quarter stocking them for the past one to five years. And a whopping majority — 94% — say that sales are trending upward.

Southern California grocery store chain Gelson’s Markets became the first grocer to carry the plant-based Impossible Burger in its fresh and frozen meat cases, as progressivegrocer.com reported last September. Gelson’s plans for the product extend beyond the meat case, however.

“People who shop at Gelson’s know and appreciate great food, and the Impossible Burger is going to become a go-to favorite in home-cooked meals, from dim sum to barbecue,” says Rob McDougall, the Encino, Calif.-based company’s president and CEO. “We’ll also be unveiling delicious new recipes featuring Impossible in Gelson’s Kitchen and offering an Impossible Burger at our Wine & Tapas bars.”

In January, The Kroger Co. started rolling out Simple Truth Emerge: Plant Based Fresh Meats, an expansion of the grocer’s natural and organic private brand. The new line offers fresh, pea protein-based meatless burger patties and grinds, an addition to the grocer’s plant-based options added last September.

And last spring, Bristol Farms’ Yorba Linda, Calif., store rolled out plant-based meats and entrées at the butcher counter, according to San Diego-based Before the Butcher, which supplies the store with plant-based chicken burgers and breakfast sausage, as well as items like no-meat taco mix, vegetarian meatloaf, vegetarian stuffed cabbage, chorizo-stuffed potatoes and a Mediterranean meatless patty made by Bristol Farms chefs using Before the Butcher’s ground products.

The NPD Group’s “Future of Plant-Based Snapshot” study, reported last November, found that Millennials, born between 1981 and 1996, are the top consumers of plant-based meat alternatives.

Gen Xers, born 1965 to 1980, are also a core consumer group of plant-based meat alternatives, and because many in this group are parents of Gen Zs, born 1997 to present, they’ve raised their Zoomer kids on plant-based beverages and foods. Boomers are decelerating their consumption of plant-based meat alternatives, but are the top consumers of plant-based dairy alternatives.

NPD’s research shows that 90% of plant-based users are neither vegetarian nor vegan, further solidifying the growth of flexitarianism.

And a Michigan State University (MSU) “Food Literacy and Engagement” study, released last October, delivered these key findings:

- 35% of Americans have consumed plant-based meat in the past year; 90% say they would do so again.

- 42% haven’t consumed plant-based meat, but are willing to try it.

- 30% are unwilling to try it.

- Of consumers already eating plant-based meat, 48% are under 40 years old and 27% are over 40.

Looking ahead to the next frontier, cell-cultured meats, the MSU study revealed that 35% of American consumers say they’re likely to buy cell-cultured meats; 49% of these consumers are under 40 years old, and 25% are 40 and older.

- Methodology

Progressive Grocer’s Retail Meat Review survey was fielded online by EIQ Research Solutions in November and December 2019 to supermarket retailers involved in the meat/seafood category. A total of 44 responses are included in these results, split between operators of fewer than 10 stores, 10 to 99 stores, and 100 or more stores. By title, 60% are from the c-suite (owner, CEO or executive over fresh departments); 23% are category managers, merchandisers or buyers; and 11% are store managers, with the remainder serving in various capacities, including marketing, consulting and analysis. Among the respondents, meat represents about 20% of their total sales.