Decision Drivers in Supermarket Prepared Foods

In food retail, as in all retail today, what was true three years ago may not be true today or tomorrow.

Chicago-based research firm IRI finds that retail foodservice has added $1.79 billion in sales to grocery stores since 2015, but as the category matures, growth has declined. The most robust year-over-year growth of 7.85% in 2016 has slowed to 2% growth in 2019. The challenge for grocery store operators is to regain previous growth rates and take even greater steps forward as we enter a new decade.

Key Takeaways

- Merchandise kids’ boxed lunches, protein-based snack packs and packaged treats at a dedicated cash-out kiosk for grab-and-go convenience.

- Partner with a local coffee roaster, juicery or sandwich maker to differentiate your foodservice; also, use recipe cards and in-store incentives to move people from the deli to other store categories for meal-building ideas.

- Use Facebook, Twitter, e-blasts and texts to tell shoppers what’s hot for lunch, as well as for dinner and breakfast. Look into dark kitchens or build partnerships with Instacart, DoorDash, Uber Eats and local delivery services to keep the stay-at-home crowd happy.

According to the FMI — The Food Industry Association's most recent “Power of Foodservice at Retail” report, in 2019, household penetration for grocery foodservice grew to 94.1% — still below the 98.8% for the total deli department. And while consumers averaged 161 grocery trips per year, just 28.3 trips included a deli purchase and 20 included grocery foodservice items.

The promise of the fresh perimeter to fight against online grocery sales has also softened, with the latest year showing 1.3% growth compared with 4% the year before, notes Jonna Parker, principal of IRI’s Fresh Center of Excellence.

Arlington, Va.-based FMI’s report finds that the highest share (31%) of survey respondents want to see flavor and item rotation on a monthly basis, but 28% want even greater levels of innovation and recommend a weekly or even daily rotation.

Fighting Sameness

These challenges can be met by building on the basics: FMI’s report notes that 88% of shoppers want to see more new items and flavors in retail foodservice.

“The assortment needs revision,” Parker affirms. “What is striking is, across all store types, from budget to high-end, the basic prepared food offerings are the same, but they need to change to keep pace with the varied, exciting, multicultural food options consumers can find elsewhere. The deli has to be a point of differentiation — from other stores, from restaurants, and from other competitors like convenience stores and food trucks.”

She continues: “Lack of change and expansion in product assortment are consistent complaints. Shoppers want to see more options — both in flavors and sizes — in appetizers, sauces, charcuterie, soups, sides and sandwiches.”

Surveys by another Chicago-based research firm, Datassential, indicate that operators are hearing the message. Datassential’s senior publications manager, Mike Kostyo, observes that 68% of supermarket operators say that they expect prepared offerings to be more important to their overall store in two years, while three-quarters say that they’re actively trying to grow their prepared food sales overall.

Jill Failla, an analyst in the foodservice sector at Chicago-based Mintel, advises retailers that if they can make only one change in the depth and range of foodservice offerings, make it local.

“Build a local brand partnership, and call this out in store signage and promotions,” Failla recommends. “Even if you bring in just a few local elements, like tortillas made from local corn, or local kombucha in your café, this distinguishes your selection from other stores.”

She adds that, especially among Millennials and Gen Z consumers, who are high users of prepared foods, snack options are particularly important. “Offering local smoothies or baked items can drive store choices and increase time spent in-store.” Failla asserts.

Another way to build partnerships is by connecting with third-party prepared food manufacturers. Kroger’s Simple Truth brand, which recently expanded to include a plant-based collection, is an example of a third-party partnership going big. A recent report, “The Power of Private Brands” by FMI and IRI, reveals that 46% of consumers say that store brands influence their store choice, versus just 35% three years ago.

IRI's Parker notes, “Third-party manufacturers have more money and resources to research trends, develop recipes and put some marketing momentum behind these offerings.” She finds that when shoppers do see something new, like a line of private label meals or more plant-based selections, sales pop. These patterns should encourage operators to add more variety in dishes like veggie-forward entrées, new snacks and grain-based salads.

Even Better Better-for-You

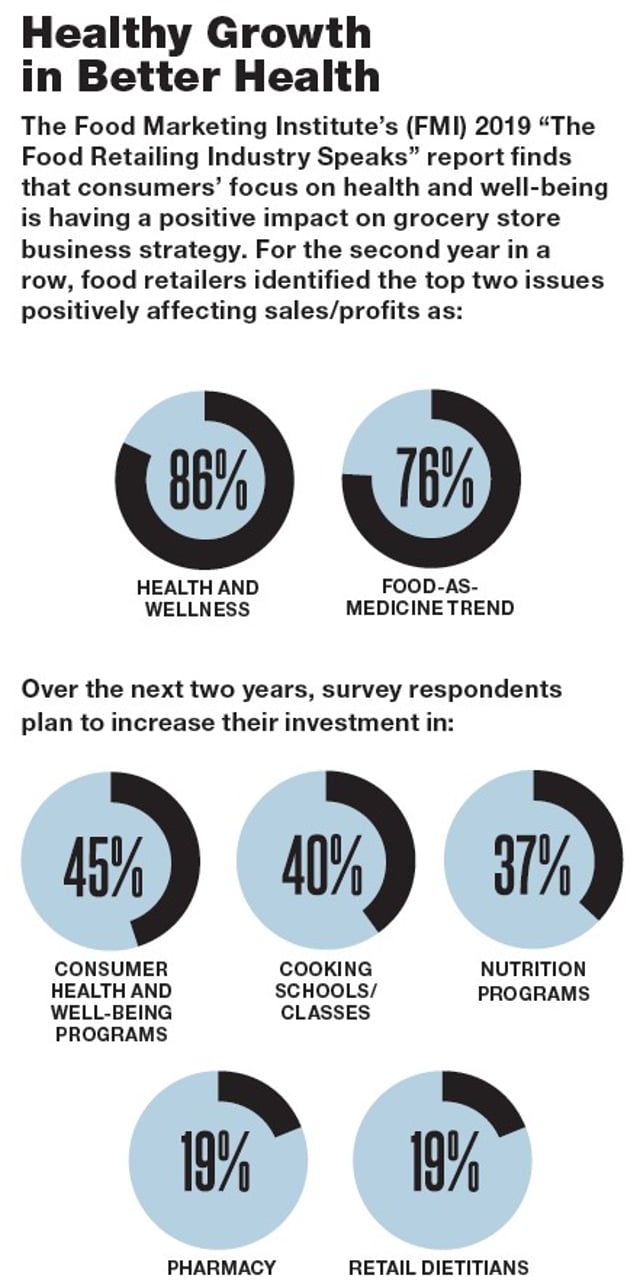

In fact, grain and vegetable dishes speak to existing strengths that operators should play to. Grocery prepared food already has a health halo because it’s seen as fresher and better-for-you than quick-service restaurants’ offerings. Kostyo notes that 41% of consumers say that the availability of healthy options affects where they go and what they decide to order when purchasing food away from home.

Shelley Balanko, SVP at The Hartman Group Inc., in Bellevue, Wash., also sees an expanding definition of health food that includes ingredient transparency, sustainability, less wasteful packaging and other better-for-the-earth considerations.

“Consumers are telling us it’s important that better health and convenience are not mutually exclusive,” Balanko says. “Even in snacking, we see consumers trading the usual salty snacks for options with more nutrition density, like roasted legumes.”

She recommends that operators make the most of snacking occasions: “Think differently about portions, variety and packaging.”

Convenience as Table Stakes

One thing never seems to change: Eaters have a need for speed. FMI research shows that the grab-and-go, ready-to-eat options are most popular in prepared foods, with 68% of consumer respondents expressing interest in such products; grab-and-go, heat-and-eat is the second most-popular style, at 63%.

U.S. households need help getting dinner on the table, with home-cooked meal occasions dropping to an average 4.5 per week and showing decreased frequency across most demographics, according to FMI. Meal planning is also on the decline; FMI finds 42% of households try to plan dinner for the next few days, while 29% go one day at a time.

For her part, Balanko calls dinner a “one-hour decision,” noting: “Our research finds that 44% of consumers buy from the prepared food section one to three times a month, and 19% buy from the section once a week or more. Younger shoppers show more frequency. Dinner is the most purchased daypart, at 21%; 18% is lunch; and 10% is breakfast.”

These results show that foodservice at retail continues to capture consumer attention, and that there’s room to increase frequency across all dayparts.

As to why shoppers are buying prepared food at retail, top decision drivers include the following: It’s a better option than cooking, it’s quick, and it’s more convenient than restaurant usage.

“I encourage retail foodservice operators to build a new model of convenience,” Balanko says. “Traditional convenience was focused on being easy, quick and accessible. A new model is engaging, empowering and flexible. Convenience can help people build their kitchen skills, learn about a new cuisine, or snack more wisely with portioned foods that are single-serve but not wasteful.”

Many operators have seen success with cross-sectional shopping guidance and incentives.

Operators also need to take their successes a step further and think like restaurants do.

Out-of-Store Considerations

LTOs and price incentives go hand-in-hand with marketing outreach, and this is an area where restaurants continue to have the upper hand over prepared foods at retail. Parker encourages grocery store operators to tap their frequent-shopper programs to expand customer outreach.

“Most stores have some kind of frequent-shopper program, but few have time to mine the data and learn who is buying vegan frozen options or who would opt in to texts about daily menu specials,” she observes. By contrast, most consumers can check Facebook to find a food truck location, or they get texts about the two-for-one pizza special in town.

2020 Total Meal Solutions Summit

Progressive Grocer will host its next Total Meal Solutions Summit in Chicago Aug. 30-Sept. 1, 2020. Visit the summit website for announcements, as well as highlights from our 2019 summit: www.totalmealsolutions.com.

And speaking of pizza delivery, grocery stores need to get in the driver’s seat when it comes to food delivery. Some of the cross-store advantages supermarkets offer in-store translate well to delivery options. For example, Instacart can deliver a prepared pasta-and-bagged-salad meal for dinner in an hour, plus eggs, milk and toilet paper for tomorrow. Grocers need to get the message of prepared food delivery in shoppers’ minds when they’re at home or work, and social media can do that.

FMI finds that grocers have made inroads with app-based shopper interactions, but more work remains to be done: 42% of shoppers say that they actively use a grocery store app, yet 78% of those shoppers use the apps as they would a printed circular. Further, 53% use apps for ordering groceries for pickup or delivery, but only 38% order deli prepared foods using an app.

“We’re learning that consumers look at prepared foods as a continuum,” Balanko says. “On one end is the fully ready-to-eat meals ordered online and delivered door-to-door, and on the other is pre-chopped vegetables that provide some at-home cooking efficiencies.”

Grocers need to think of everything in between as another opportunity to meet shoppers where they are.