Hard Ciders Are Still Finding a Place in Shoppers' Carts

Hard seltzers and flavorful ready-to-drink cocktails may be darlings in the adult-beverage world right now, but hard ciders are still finding a place in shoppers’ carts. According to Chicago-based insights firm NielsenIQ (NIQ), hard-cider sales racked up $530 million in 2022.

Cider is appealing in that it crosses adult beverage types, typically categorized with beer, sometimes produced by wineries and occasionally competing with seltzers. It’s a versatile beverage, too, available in a range of flavors and styles, including sweet and dry.

[Read more: "Albertsons Cos., Safeway Try Out Wine Delivery"]

Although cider sales are off from previous highs — sales have slipped 6% over the past two years, per NIQ — there are innovations and opportunities for future growth in the category. In its report on hard ciders released earlier this year, NIQ underscores the growing appeal of local brands, akin to the craft beer movement, and shares the finding that 54% of total hard-cider sales come from regional and local brands. Other research shows that regional ciders are outpacing many categories within the total beer sector in terms of year-over-year growth.

Blake’s Hard Cider, one of the largest craft cideries in the Midwest, has tapped into that market successfully.

“Millennials continue to drive the growth of the craft beverage segment, due to their views on supporting local/regional brands and wanting products that are made on a more micro scale versus macro; these products tend to have a more authentic and feel-good story,” points out Chelsea Cox, VP of marketing for the Armada, Mich.-based company, adding, “The gluten-free fruited alcohol category continues to see monumental growth, and it’s not from women alone — more men are consuming hard cider now than in the last 50 years.”

Leaning Into Flavor

In addition to local appeal, flavor is a competitive advantage for hard ciders. According to NIQ’s report, the flavors showing the biggest year-over-year growth include cucumber, blueberry, passionfruit, tea peach and strawberry lemonade. Cucumber hard-cider sales alone rose 3,960%, the data shows.

Cox agrees that flavor is a draw for these adult-beverage products. “We’re also seeing the pendulum swing back from faint-flavor beverages like seltzers to full flavor,” she notes. Among other new items, Blake’s Hard Cider rolled out a Cherry Limeade variety this year.

On that flavor note, other hard-cider brands are leaning into flavor to juice up the category. Walden, N.Y.-based Angry Orchard Cider Co. recently added a Blueberry Rosé hard cider to its assortment. Meanwhile, Corvallis, Ore.-based 2 Towns Ciderhouse often releases limited varieties like Piña Fuego, a chipotle pineapple cider, and Spice, Spice Baby, a honey-spiced cider.

Variety packs are a way to deliver more flavor options to consumers looking to mix it up. Woodchuck Hard Cider, based in Middlebury, Vt., offers a Brunch Box containing Paloma, Mimosa, Bellini and Bubbly Pearsecco flavors, while Virtue Cider, of Fennville, Mich., has put together a variety pack with Brut, Rosé, Apple and Cherry hard ciders. Additionally, Angry Orchard’s new Blueberry Rosé is part of a pack with Crisp Apple, Green Apple and Tropical Hard Fruit ciders.

Time of the Season

Seasonality plays into the merchandising and sales of hard ciders. Fall is a typically popular time for these beverages, given their association with apples that are harvested and marketed at that time of year, and consumers’ swing away from seltzer-style drinks as the temperature cools. That said, many beverage companies tout cider as a summer drink, too, for its refreshing, crisp taste.

Blake’s, for one, reports that it actually shipped more hard cider last June than in any other month of the year. “We really led the way in developing adventurous flavor profiles to complement the seasons, like triple berry, peach, pineapple and limeades that expand the cider-drinking opportunities to spring and summer occasions,” says Cox.

Even winter can be tied into hard ciders. Virtue Cider produces an ice cider called Flok, made with Michigan apples and blended with cider aged in French oak barrels for a taste that combines overripe apple, spice, honey, caramel, and notes of ice wine and brandy.

The Imperial Difference

Imperial-style cider, with an ABV of 8% or more, is an emerging subcategory within hard ciders. 2 Towns Ciderhouse, which has offered imperial ciders for several years, has added new offerings to that line, including a Cellar Series of oak-aged honey, apricot and nectarine imperial cider made in limited quantities. According to Cox, Blake’s is introducing a new American Berry imperial cider in August.

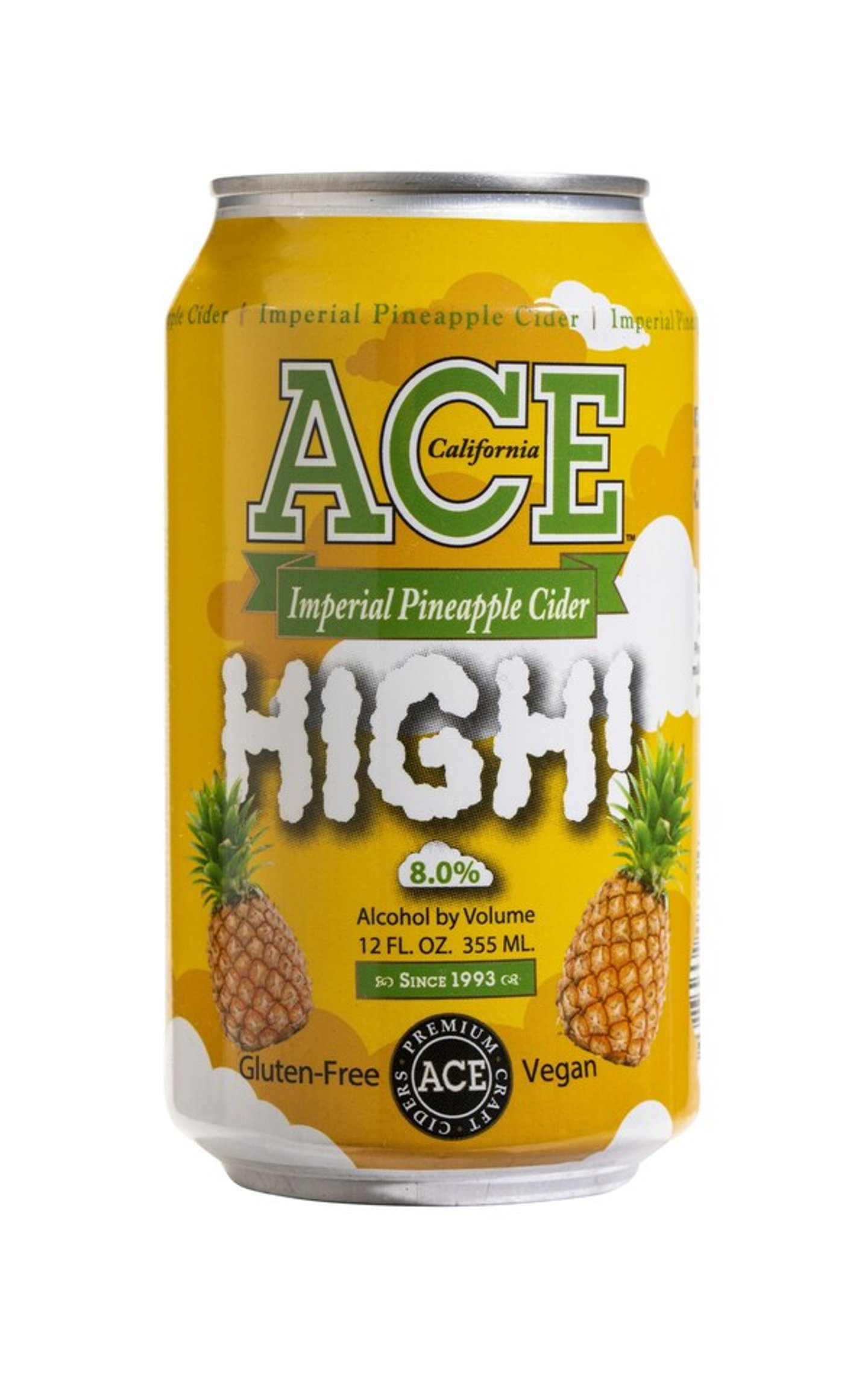

Ace Cider, based in Sonoma County, Calif., recently added a pineapple flavor to its collection of High Imperial hard ciders. “With this launch, Ace will be the only craft cidery with four imperial ciders and a footprint in all 50 states,” says Jason Strobbe, the company’s SVP of sales. “Our flavors are unique to the category and proving to provide strong consumer appeal in a fast-growing category.”

Better All Around

Meanwhile, as consumer interest in sustainability grows, hard-cider brands with a sustainability story to tell can gain traction among mindful drinkers. The NIQ report emphasizes the finding that 46% of consumers want brands to offer sustainable products, and that younger adult-beverage drinkers in the Gen Z age demographic connect consumption and earth-friendly practices.

If the better-for-the-planet claim is a point of difference, so are better-for-you hard-cider varieties.

According to NIQ, hard-cider brands with the product claim of “carb free” are up 353% in dollar sales over the past year. Further, a recent report from Chicago-based research firm Mintel shows that 48% of U.S. adults would be more likely to try an alcoholic beverage if it were naturally flavored. In that same report, Mintel notes that cider brands are working to provide consumers with more natural options “by reducing additives and preservatives, sourcing organic ingredients, and highlighting all-natural recipes.”

Blake’s is one brand that has moved into this subcategory, adding a Jam Session Lite Cider to its lineup this year. The beverage has 80% less sugar compared with leading national cider brands — only 4 grams per serving — and it contains just 110 calories.