Exploring the Protein Boom: The Main Ingredient Dominating Grocery Shelves

More Protein Coverage

Protein, it seems, is everywhere. As we move deeper into the ’20s, grocers are flexing their merchandising muscle by carrying a greater variety of both animal- and plant-based proteins across more categories, from powders to meats to desserts.

Market research supports the push for protein. According to a recent report from Arnhem, Netherlands-based Innova Market Insights, 42% of consumers believe that proteins are the most important ingredients to them.

While they have more to choose from, protein-propelled shoppers are being driven by certain trends as 2024 gets underway. In a decade defined by the constant of change, some of those trends are emerging now, while others linger from macro events that have shaped the marketplace over the past few years.

[Read more: "Food and Beverage Poised for More Promising 2024: Report"]

Value Remains Vital

One continuing protein purchase driver is consumers’ quest for value. Although inflation has come down from its peak, food prices remain elevated over traditional levels. More recently, there has been speculation about the possibility of disinflation or deflation over the coming year, causing a different kind of uncertainty.

In this tenuous climate, consumers remain in caution mode, even as they keep protein in their diets. Anne-Marie Roerink, principal at San Antonio-based research firm 210 Analytics, agrees that affordability is still a key issue. “Sustained financial pressure has resulted in some moments being focused on money well saved, whereas others are focused on money well spent,” notes Roerink. “With virtually everything in life costing more, from food to energy to gasoline and insurance, consumers simply have less disposable income, and that is felt across all income [levels].”

As a result, shoppers are weighing choices carefully in an effort to scrimp when needed and savor when possible. “Rather than a singular focus on price, consumers sometimes focus on ultra value, whereas other times it’s about finding a good deal and saving some time, doing something nice for themselves or others, something that’s a bit healthier, more sustainable, et cetera,” she explains. “But one thing is for certain: Sales patterns continue to reflect a consumer who is balancing how much, what and where they purchase, with a big emphasis on sales specials.”

Roerink cites examples in the meat and poultry sector. “Chicken, with its very cost-effective price per pound, is doing well, as are grinds,” she observes. “While ground beef is not quite keeping pace with year-ago levels, it, too, is doing better than most whole-muscle cuts in beef.”

Ozlem Worpel, VP, marketing and innovation at Merriam, Kan.-based Seaboard Foods, sees similar circumstances among price-wary consumers who continue to cook more at home. “Looking at the numbers, almost 60% of food sales for the year to date are home meals, and I don’t think 2024 will be much different,” says Worpel.

Pork has an opportunity to shine in this market, she adds “Pork overall is a value protein, and is the only meat that has gone down in price per pound for the last 52 weeks,” notes Worpel. “When consumers are looking for a protein to include in their meals, I’m hoping we do a good job reminding them that pork is a value. It carries flavor very well, and it’s versatile.”

Worpel agrees that eating occasions often toggle between premium and value experiences.

That’s one reason, she continues, that Seaboard’s Prairie Fresh USA Prime pork line has fared well since it launched in early 2023. “People are eating at home more, and when they do, they are making sure they have the best product possible,” explains Worpel.

Chicken, which has long worn a value halo, is another category where retailers promote value and shoppers seek it. According to research cited by the Washington, D.C.-based National Chicken Council, 95% of consumers who buy chicken say that price per pound and overall price are more important or as important, compared with a year ago. As for the coming months, the Utrecht, Netherlands-based global research firm Rabobank reports that a combination of easing demand and fewer imports has caused the global market for poultry to slow, although it’s poised to improve gradually in early 2024.

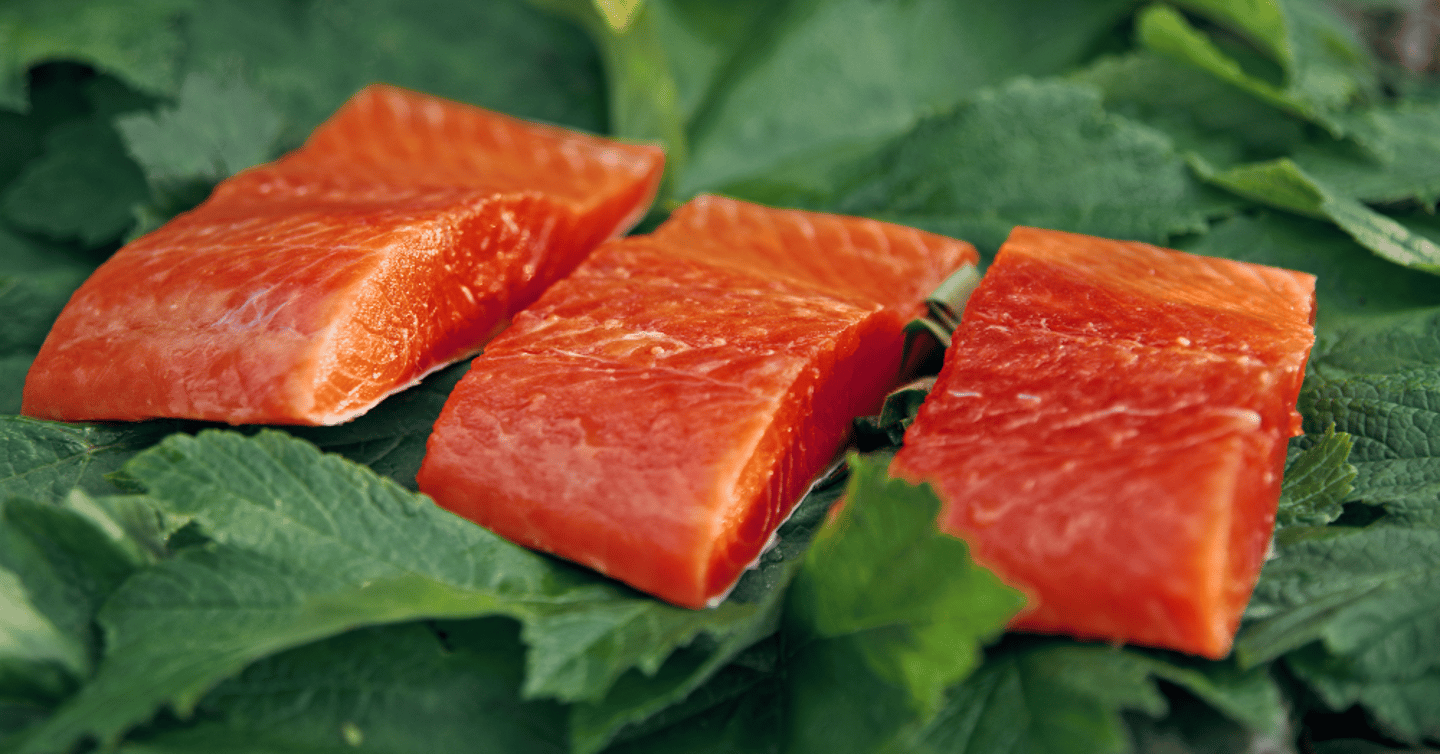

A gradual improvement in the seafood arena is likewise seen by Sarah Wallace, marketing specialist at Alaska Seafood Marketing Institute (ASMI), which is based in Juneau. “Salmon and shrimp are historically the most widely consumed types of seafood throughout the U.S.,” says Wallace. “While that likely won’t change in 2024, overall seafood consumption will see an upward trajectory as inflationary pressures ease, with many seafood consumers likely to add more species back into regular meal rotations.”

[Read more: "Plenty of Fish Opportunities in Retail"]

She goes on to note that consumers also show preferences toward species like wild Alaska cod and pollock. “As inflationary pressures ease, we expect to see shoppers branching back out into these other species, as well as embracing trending products like smoked salmon and tinned fish,” predicts Wallace.

Meanwhile, people aren’t talking about skyrocketing egg prices the way they were just a year ago. According to a late November report from the U.S. Department of Agriculture (USDA), wholesale prices for cartoned eggs are steady, with light to moderate supplies, and demand remains moderate to good. Here, too, shoppers bounce between more affordable store-brand eggs and branded eggs with some kind of value proposition, like a new line of “restorative” eggs from Vital Farms, of Austin, Texas.

Plant-based proteins aren’t subject to the same inherent supply-and-demand constraints that animal proteins are, but in today’s price-centric environment, some manufacturers are touting value items in a segment that has typically been more premium. Beyond Meat, based in El Segundo, Calif., introduced a plant-based sausage in mid-2023, while many retailers continue to develop store-brand plant-based proteins. The New York-based Private Label Manufacturers Association (PLMA) identified “plant-based power” as one of five major trends during the group’s recent trade show in Chicago.

As protein suppliers provide a mix of products and messaging for mindful shoppers, grocers are finding their own ways to meet shoppers wherever they are on their value journey. “Retailers are actively addressing consumers’ quest for value with more frequent promotions,” notes Roerink. “One area of improvement is still the depth of the discount where possible. Other retailers compare the cost of a home-cooked meal to a restaurant meal, boost their private-brand assortment, have adjusted their assortment to provide more value cuts, and try to be creative with shorter discounts such as one-day or bundling items into meal discounts.”

Raising the “Better” Bar

Although the word “value” typically connotes price, consumers are also continuing to make choices about what they eat or drink based on their own values. Because proteins are so tied to agriculture, including proteins that come from animals and those that are derived from plants, sourcing and sustainability remain key factors within the greater protein marketplace.

In its recent report on food trends for 2024, FMCG Gurus highlights the “green horizon,” with an increasing use of upcycled ingredients and a focus on production practices. According to the U.K.-based market research firm, eight out of 10 global consumers say that they would trust a company more if it were using regenerative-farming practices.

For her part, Roerink expects consumers’ interest in where food comes from to continue to shape their protein selections in the short- and long-term future. “Consumers connect the dots between planet, people and animal welfare,” she observes. “While it’s easy to imagine that this is an area under pressure when money is tight, we still see consumers emphasizing sustainability in all its aspects. Following trends seen in European retail, the U.S. market is seeing everything from rating systems to third-party audits to sourcing standards being shared online.”

Worpel also believes that sourcing will stay top of mind. “Sustainability is here to stay,” she asserts, emphasizing the importance of measuring processes and being transparent to consumers, especially younger buyers.

Concerns about sustainable food systems have led to the development of cell-based proteins as an alternative, a trend that experts expect to continue. In its outlook for 2024, the New York-based Specialty Food Association (SFA) includes cell-based meat and seafood as a trend. “Historically, this has been a challenge for producers, as the textures are particularly hard to mimic,” says Chala June, a member of SFA’s Trendspotter panel. “But with advancing technology, more brands are going to take a swing at it.”

Health is another personal value that spurs consumers to make certain choices when it comes to protein, as protein sources are generally rich in essential nutrients. “While very restrictive diets seem to be on the decline, protein continues to be an important nutrient that many consumers look for,” affirms Roerink.

Meanwhile, in the Kitchen

Consumers shop for protein with other values in mind, too. Convenience has come back to the forefront, for example.

“Life is hectic at the same time that many consumers try to find a better work/life balance,” says Roerink, emphasizing that grocers can hang their promotional hat on that attribute. “The convenience win is a continuum from straight-up raw meat that requires cooking and seasoning from scratch, to fully cooked, and everything in between. The deli and meat departments are rapidly breaking down silos, with deli sides moving into the meat department and many ready-to-cook dishes [in] ovenable/microwaveable packages moving into the deli department.”

In its 2024 trends outlook, Chicago-based insights firm Midan Marketing likewise called out convenience as a priority. “In a world where we can stream any content we want on any device at any time and have whatever we want to eat delivered right to our front door, convenience has become ingrained in our culture,” the company’s report points out. “So it’s not surprising that the number of consumers who say they frequently purchase value-added meat has more than tripled since 2016.” According to Midan’s latest meat consumer segmentation research, 29% of consumers say that it’s worth paying extra for meat products that save them time.

Education is important in making protein preparation easier for consumers. “The 60% of consumers who eat seafood at home once a week are continuously on the lookout for new usage inspiration,” notes Wallace, citing a recent ASMI study showing that 74% of consumers wish they were eating seafood more often than they already do, and 66% say that easy cooking tips and recipes would help them eat it more.

Even as consumers seek out shortcuts, they’re not cutting down on flavor. According to Wallace, “Flavor trends for seafood recipes are following many of the major flavor trends across the food industry, including increased global influence, flavor fusions — most notably sweet and spicy — and refreshing flavors like botanicals and citrus.”

Seaboard Foods, for its part, has focused on shoppers’ interest in more variety with its Prairie Fresh Signature line of seasoned pork. “If you do that at home, you have to buy different ingredients, and you will only use so much of them,” says Worpel. “This way, you are spending less. She adds that the company is launching a new seasoned product in early 2024.

Certainly, there are examples of interesting flavor additions across the store, whether it’s a new apple cider bacon from Hormel Black Label, Sesame Crusted Smoked Yellowfin Tuna from Brooklyn’s Acme Smoked Fish or cereal-inspired plant-based protein shakes from the Koia brand, among dozens of other examples of recent product rollouts.