Consumers Prove Resilient – Again

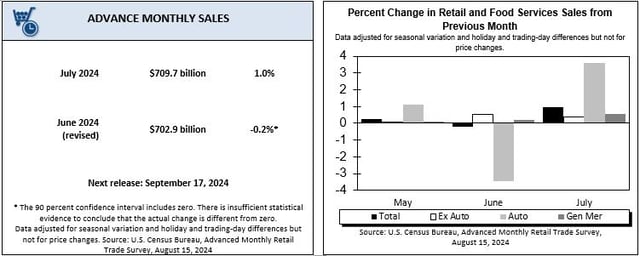

The idea that shoppers are adapting to economic headwinds with shifting spending habits instead of larger-scale pullbacks is reinforced by fresh data. According to the latest report by the U.S. Census Bureau, overall retail sales rose 1.1% from June to July and are 2.6% higher than last year.

That upswing reflects the shopper resilience that has become a hallmark of the decade. The news comes a week after a worse-than-expected jobs report spooked financial markets and led to speculation about action by the Fed.

RELATED: Reading the Inflation Tea Leaves

“Following stalled retail sales in May and June, the U.S. Census Department of Commerce reported a solid 1% month-over-month rise in July, representing the biggest jump since early 2024 and surprising economists,” observed Chip West, retail and consumer behavior expert at Chicago-based R.R. Donnelley & Sons Co., which recently acquired Vericast’s digital and print marketing businesses.

The grocery sector was in line with the general sales lift. Census Bureau data showed that sales at U.S. grocery stores went up 1% last month on an adjusted basis to $74.91 billion, from $74.19 billion, a period in which food-at-home prices rose 0.1%. For the first seven months of 2024, grocery sales were 1.8% higher than the prior year, topping $514.6 billion.

In contrast, sales at foodservice and drinking places inched up 0.3% from June to July.

“Food prices stabilized in grocery stores more quickly than in restaurants, with the cost to dine out staying higher than groceries. As consumers continue to be choiceful with their spending, grocers are catering to value-seeking shoppers by stocking shelves with store brands, which creates a tough environment for premium food brands. Retailers that want to stay top of mind for consumers will have to continue offering deals and value,” asserted West.

E-commerce sales in July were also moving in a positive direction. The latest Brick Meets Click/Mercatus Grocery Shopping Survey showed that the total U.S. online grocery market experienced a 9.2% year-over-year (YoY) gain to reach $7.9 billion in sales last month.

That survey also found that overall e-grocery order volume went up about 5% last month on a YoY basis. The growth was fueled in part by a 20% surge in delivery orders; Brick Meets Click and Mercatus pointed to successful efforts by key delivery players.

“Walmart and Instacart aren’t the only players using deep discounts to boost delivery demand,” said David Bishop, partner at Barrington, Ill.-based Brick Meets Click. “Amazon, for example, in July offered a 90-day free Prime membership trial instead of the usual 30 days, along with unlimited grocery delivery. Similarly, DoorDash and Uber Eats are maintaining low or no delivery fees to increase their market share.”

Mark Fairhurst, chief growth officer at Toronto-based Mercatus, shared his thoughts on the implications for grocers. “Intense competition in grocery delivery promotions is eroding regional grocers' control over customer interactions. While third-party marketplaces may boost short-term order volume gains, they also make it harder for grocery retailers to achieve the economies of scale needed to reduce operating costs,” noted Fairhurst. “I’m not sure many grocers would jump at the opportunity to put a farmers market in their store parking lot, yet many are willing to do something similar when it comes to relying on marketplaces for their online business.”