Grocery Sales Inch Up in November

The latest retail numbers are out, and affirm that consumers remain in buying mode, albeit on a tempered scale.

According to fresh data released by the U.S. Census Bureau, overall retail sales edged 0.3% higher in November, beating economists’ projections of a 0.1% to 0.2% decrease. On a year-over-year (YoY) basis, retail sales are up 4.1%.

[Read more: “Inflation Steady But Shoppers Still Cautious”]

Adjusted sales at grocery stores held steady in November, one of the busiest months of the year for food retailers due to the Thanksgiving holiday. Sales hit $74.3 billion last month, a tick higher than the $74.2 billion in October, the Census Bureau reported. In another indicator of the steady sales picture, grocery sales rose 0.1% from October to November and increased by the same 0.1% rate over November 2022. For the 11 months of 2023, the latest government data shows that grocery store sales came in just shy of $806 billion, a 2.6% gain over the first 11 months of 2022.

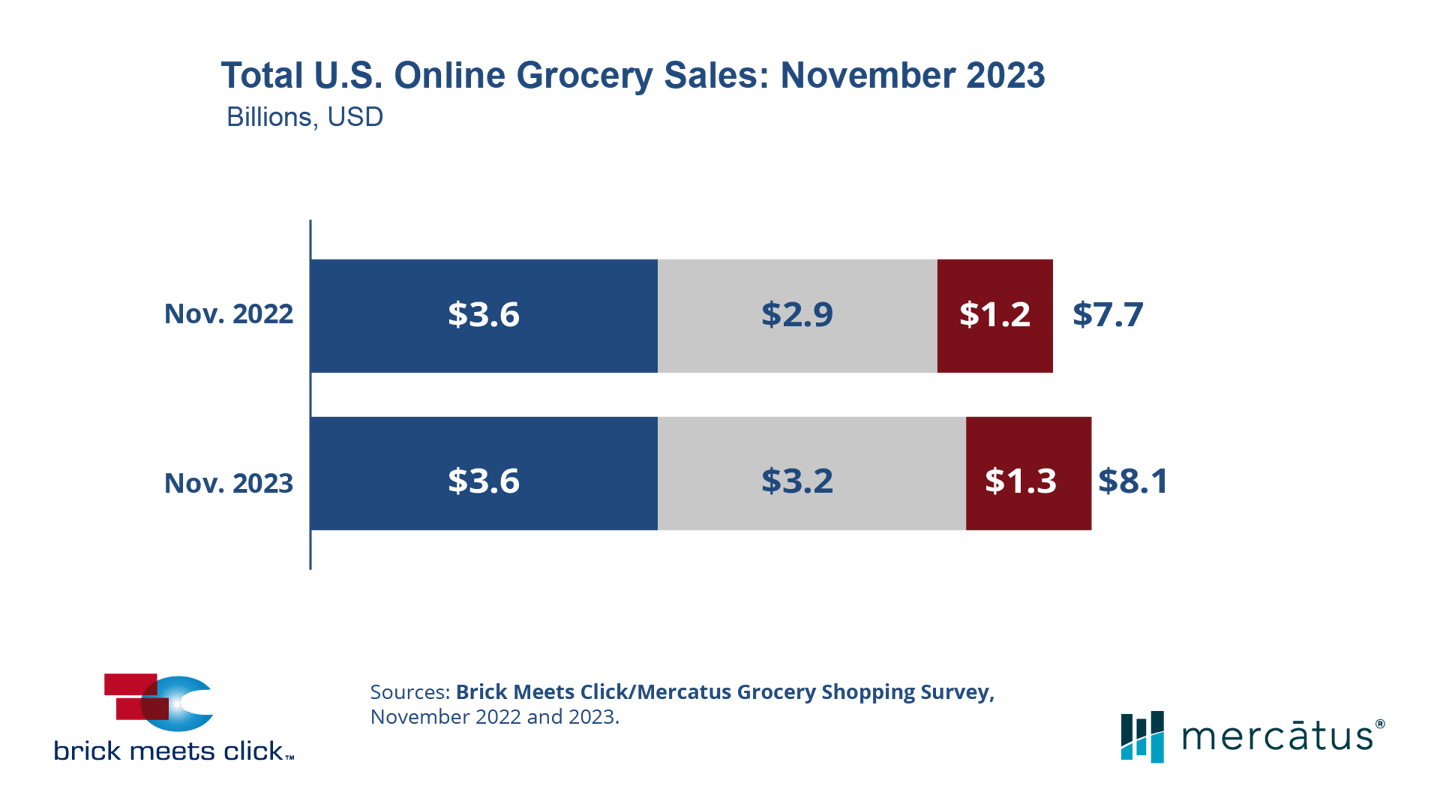

Meanwhile, other new data focused on the digital marketplace shows that consumers are spending but shopping around for value. According to the latest Brick Meets Click/Mercatus Grocery Shopping Survey, the online grocery market in the United States rose 5.2% on a YoY basis in November to reach $8.1 billion.

The report from Brick Meets Click/Mercatus also reveals that mass merchandisers surpassed supermarkets last month to become the main retail format that most households relied on for grocery purchases. The research indicates that 42% of U.S. households used a mass retailer for most of their in-store or online grocery purchase in November; back in May, 42% of households reported that they chose supermarkets for their primary store for that month, compared to 39% for the mass channel.

“The current economic realities and omnichannel strategies are aiding mass retailers in attracting more customers today,” said David Bishop, partner at Brick Meets Click. “The price advantage that a mass rival, such as Walmart, enjoys is motivating cash-strapped households to shift where they shop, and mass customer engagement strategies are making it easier for those customers to shop the way they want.”

Still, there is a continued elevated level of cross-shopping between mass and grocery, the researchers found. In November, the percentage of households who bought groceries online from both grocery and mass during the month rose 300 basis points compared to last year.

"Considering the challenges regional grocers face today in acquiring and retaining customers, it's worth recalling the phrase 'A bird in the hand is worth two in the bush,'" remarked Sylvain Perrier, president and CEO of Mercatus. "This adage underscores the importance of paying closer attention to current customers' expectations for online services and then delivering the kind of experience they want. While easier said than done, it requires a clear strategy and plan to execute.”