Annual Report: A Proliferation of Omnichannel Investments

(Editors' Note: This is the final part of a five-part series.)

Technology continues to change at a rapid pace, and grocers have every intention of trying to keep up, according to Progressive Grocer’s Annual Report survey. A majority — 63% — of retailers expect technology spending to increase at their companies during 2020.

Read the Rest of the Report

Advancements in technology hit No. 4 on the list of issues keeping retailers up at night, with online sales/omnichannel coming in at No. 7 and data protection/security coming in at No. 9.

Grocery has traditionally been slower to embrace ecommerce sales, but the demand for omnichannel will continue to grow — and maybe even explode — in the coming months and years, especially as COVID-19 accelerates customers’ usage of home delivery and click-and-collect services.

The number of retailers implementing new fulfillment options is increasing, with everything from Kroger’s partnership with U.K.-based Ocado for large automated sheds — six currently under construction — to a number of grocers such as Walmart and Albertsons testing a micro fulfillment model in back of existing stores.

Many consumers have embraced online ordering, particularly during the coronavirus outbreak, and tech firms such as New York-based Chicory predict that COVID-19 will be a major catalyst for widespread online grocery adoption by consumers in the United States beyond the pandemic.

Only 20% of retailers said that they have a fully integrated strategy using in-store, online and digital channels, but an additional 39% said they have a strategy that they’re executing for connecting with consumers at multiple touchpoints. The amount of retailers with a fully integrated strategy, however, did increase 11% since last year. As for those just getting started with omnichannel, 27% said that they’re in that boat in 2020.

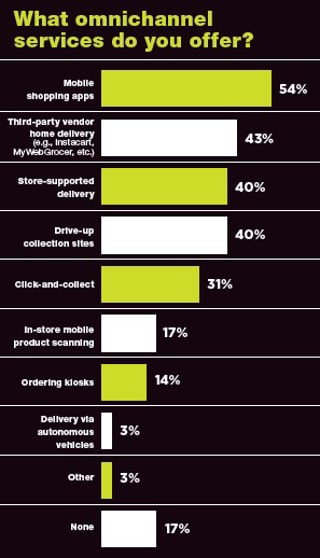

One of the greatest challenges in omnichannel is the last mile. Forty-three percent of retailers currently offer third-party vendor home delivery through partners such as Instacart or Target-owned Shipt, while 40% offer store-supported home delivery. Drive-up collection sites and click-and-collect options can now be found at the vast majority of grocers and experienced a surge in usage during March.

As for one of the most-talked-about solutions for delivery, 3% of retailers said that they currently have delivery via autonomous vehicles, with some companies such as Walmart, Kroger, H-E-B, Amazon and Ahold Delhaize USA at various stages of testing. Much of the driverless technology is currently on the road in Arizona and Texas, but as federal agencies continue to tackle regulations, further rollouts are expected in the near future. An additional 6% of retailers said that they don’t currently offer delivery via autonomous vehicles but plan to offer the service soon.

The omnichannel service garnering the most interest from retailers to implement as soon as possible is ordering kiosks, even though only 14% said that they currently have such kiosks in their stores. The kiosks can offer customers an additional engagement point and a more seamless shopping experience everywhere, from the deli and prepared food departments to checkouts and order pickups.

Reducing checkout friction has also led 17% of grocers to adopt in-store mobile product scanning, with an additional 11% planning to do so soon. As for mobile shopping apps, a majority of grocers already have these to help customers connect with their brands and make additional purchases.

In February, Amazon opened its first Amazon Go Grocery store in downtown Seattle with the tech behemoth’s Just Walk Out technology that had previously been reserved for smaller spaces and less fresh produce, in favor of prepared meals. This is something to keep an eye on as other grocers like Pittsburgh-based Giant Eagle, with tech company Grabango, also test frictionless experiences.

Tech as a whole is top of mind for most grocers, and survey respondents were asked about the best investment their companies could make to be successful in the next five years. The top response was technology upgrades/new investments.