5 Years After COVID Shutdowns, a Look at Today’s Hybrid Shopper

The notion of a hybrid shopper has become ubiquitous, five years on from the pandemic that upended the way people shop for groceries and essentials. But, what exactly, is today’s hybrid consumer and how does that person make decisions?

“This is a topic I’ve personally looked at for a long time,” said Alexandra Trott, director of sales at 84.51°, who has worked on research related to omnichannel for several years, predating the shifts that began in 2020. (84.51° is the retail data science, insights, and media arm of The Kroger Co.)

In a recent conversation with Progressive Grocer, Trott looked back on that era and how projections played out. “That was a fascinating time to be in grocery. We all had a moment where we thought, ‘Maybe brick and mortar stores are dead.’ Every retailer had ramped up their online offerings, fulfillment centers, fleets of trucks and websites,” she recalled. “We learned a year or so later that there were reasons to go back to stores, and those reasons were social. People wanted to feel connected to their community and they looked to look and see and pick things out.”

[RELATED: 76th Consumer Expenditures Study: Meet the 2025 Shopper]

Flash forward to 2025 and the current omnichannel shopper, who continues to navigate in-store and online ways of buying what they need and want. According to 84.51°'s latest omnichannel shopping report, there some notable differences in attitudes and behaviors.

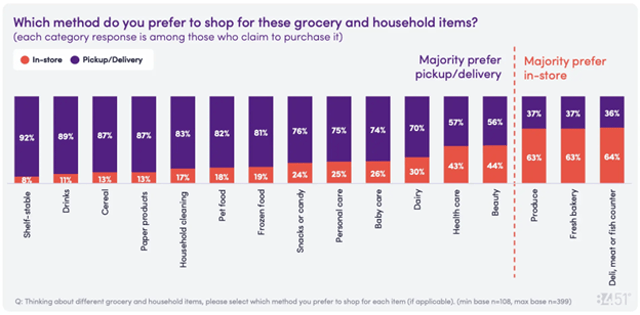

“When you ask people how they do shopping, 55% of omnichannel shoppers say they do most of their shopping online with some in-store shopping, 25% say they do mostly in-store and some online and 20% say they do online and in-store,” reports Trott. “But when you look at what they actually do, 83% of their trips are done in store and 17% are done through pickup and delivery. So, even though we’ve had this boom and growth in online, there is this massive shop in store.”

Trott foresees some changes to these numbers. “My opinion is that this will be a slow and steady climb of the online segment. The lines will blur, as there is still a purpose of brick and mortar,” she remarked.

Propelling growth on the digital side is the number of younger hybrid shoppers, especially those that formed households as behaviors were changing. According to this report, omnichannel shoppers are mainly Millennials and, often, those with children. “It’s an interesting combination, because they are highly engaged with natural and organics and want convenience, and they are larger households. They want it all,” said Trott of this cohort.

That said, omnichannel buying cuts across all demographics – and so does shoppers’ priority of getting what they want. Trott cited data points showing that 56% of omnichannel shoppers say their biggest frustration is product availability and 5% of said they would walk away from a retailer if they were continually frustrated by unwanted substitutions or out-of-stocks.

“This poses a significant risk of a shopper switches over to a different retailer and you can apply that to a brand, too,” she noted. “That has led to the importance of seamless shopping experience, where we should have great substitution methods and offer the same prices, promotions and products in-store and online. Consumers are looking for that consistency.”

In today’s economic climate, retailers and brands can help hybrid shoppers stick to budgets with e-commerce options. “One thing people tell us is that to save money, you can be very intentional online about how much money you spend – you are not throwing things down a belt and hoping you get there," Trott pointed out.

Other noteworthy findings in this report include the following data points:

- 67% of hybrid shoppers choose online to save time

- 55% appreciate the ability to shop anytime, anywhere

- 50% enjoy avoiding crowded stores

- 47% choose in-store when they are making a special trip for a specific item

- 38% don’t want to risk getting the wrong product through online orders.

- 42% value tailored recommendations, but excessive personalization can feel intrusive

84.51°’s recent report omnichannel shopping trends is available online.

The Kroger Family of Companies’ nearly 420,000 associates serve more than 11 million customers daily through a digital shopping experience and retail food stores under a variety of banner names. The Cincinnati-based grocer is No. 4 on The PG 100, Progressive Grocer’s 2024 list of the top food and consumables retailers in North America. PG also named Kroger one of its Retailers of the Century.