Supermarkets Still Rate Highest in Satisfaction, Quality, Variety: Study

According to the Retail Feedback Group’s (RFG) “2019 U.S. Supermarket Experience Study,” supermarkets still garnered the strongest overall satisfaction score (4.31 on a five-point scale) compared with deep-discount retailer Aldi (4.27) and mass merchandiser Walmart (3.93). Supermarkets additionally earned the highest scores in quality and variety.

Looking at value for money spent, however, Batavia, Ill.-based Aldi, No. 9 on Progressive Grocer’s 2018 Super 50 list of the top grocers in the United States, got the top score, as well as earning the highest overall satisfaction rating during the peak traffic hours of 3 p.m. to 7 p.m. (4.30) compared with supermarkets (4.27) and Walmart (3.98).

Supermarket shoppers rated quality/freshness of food and groceries (4.44), cleanliness of the store (4.42), and item variety and selection (4.38) as the strongest core experience factors. Associate friendliness, while achieving the highest service rating, received a score of just 4.32, followed by checkout speed/efficiency (4.28), associate helpfulness/knowledge (4.24), and the lowest-scoring service area, associate availability (4.17). Service is a key factor, since overall satisfaction is considerably higher when service attributes garner stronger scores, according to RFG.

Tying for the lowest score among core experience factors, value for the money spent garnered a rating of 4.17. In the area of specific price attributes, produce prices (3.99), meat/poultry prices (4.00) and everyday prices (4.01) all got low scores in the supermarket channel, while advertised sales items scored much higher (4.34). This is a critical strength, since 73 percent of shoppers referred to one or more advertising/sales vehicles – traditional, social, mobile and digital – before or during their store visit.

“Value still remains a very important consideration for supermarket retailers, with more than seven out of 10 shoppers referring to sales vehicles before or during the visit to the store,” said Brian Numainville, principal at Lake Success, N.Y.-based RFG. “While supermarkets receive the lowest scores on value for money spent, the good news is that advertised specials register as the strongest scoring pricing factor for supermarkets. While digital circulars (30 percent) continue to grow, the printed circular is still more popular today (51 percent), more so with Boomers (62 percent) as compared to Millennials (40 percent). However, digital coupons (33 percent) have now surpassed clipped coupons (29 percent) and are used across all age groups. Retailers need to remain attentive to the trends in their local markets to ensure they are communicating value using the vehicles most relevant to their shoppers.”

Aldi shoppers are more apt to recommend their store, with a Net Promoter Score of 44.7 versus supermarkets (40.7) or Walmart (27.1). Moreover, 42 percent of Aldi shoppers said that they intended to shop there more in the next 12 months, compared with 22 percent for supermarket shoppers and 28 percent for Walmart shoppers.

Regarding core experience ratings, Aldi shoppers assigned value for money spent the highest score (4.51) versus Walmart shoppers (4.32) and supermarket shoppers (4.17). Except for value for money spent, Walmart customers scored the Bentonville, Ark.-based mega-retailer, No. 1 on PG’s 2018 Super 50 list, lowest on the other core experience factors, compared with supermarkets and Aldi. Additionally the deep discounter has tied with supermarkets on quality and freshness (56 percent describing themselves as “highly satisfied”), with Walmart lagging behind, at 46 percent.

“As Aldi continues to remodel stores and expand into new locations, supermarkets need to step up their game in areas like staff availability and helpfulness, maintain leading scores in quality and variety, as well as focus operationally on improving satisfaction during high-traffic time periods,” noted RFG Principal Doug Madenberg.

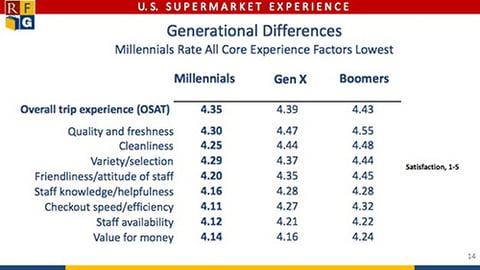

In the realm of demographics, Boomers outscored Millennials on almost all core experience factors, excepting value for money spent, which garnered similar scores across generations. Further, Boomers scored supermarkets more highly than both Gen X and Millennials on various factors, among them quality, variety and friendly employees.

The RFG study is based on a nationally representative study of 1,200 supermarket shoppers.