Frozen Food Aisle Accelerates Ahead of Other Departments

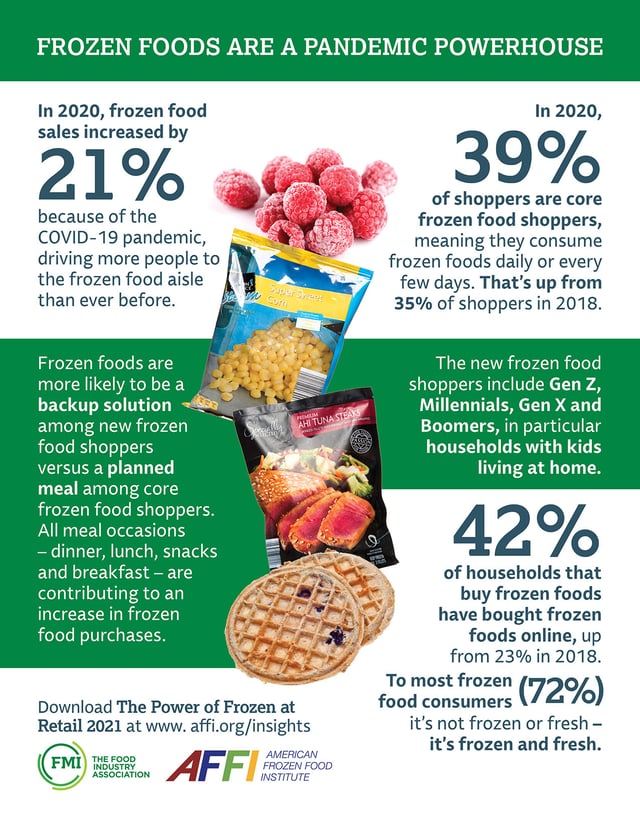

Last year, many shoppers were searching for cost-efficient items with a longer shelf life during the pandemic, and they found what they were looking for in the frozen food aisle. In 2020, frozen food sales grew in both dollars (up 21%) and units (up 13.3%), with nearly all types of frozen foods seeing double-digit sales increases, according to the "Power of Frozen 2021" report from the American Frozen Food Institute (AFFI) and FMI — the Food Industry Association.

“Frozen foods are a pandemic powerhouse, ringing in $65.1 billion in retail sales in 2020, a 21% increase compared to a year ago,” said Alison Bodor, president and CEO of Arlington, Virginia-based AFFI.

This sales surge was helped by shoppers turning to e-commerce at a record rate, as online frozen food dollar sales increased 75%. Over the past year, 42% of households that buy frozen foods have bought frozen foods online, up from 23% in 2018.

Frozen dinners/entrees, meat, poultry and seafood proved to be the biggest online sellers.

The health-and-wellness craze has also infiltrated the frozen food aisle. Frozen food consumers are most likely to be interested in “real” ingredients, followed by fresh frozen and the absence of artificial colors.

For example, Albertsons Cos. expanded its Open Nature brand in November 2020 with new flash-frozen Open Nature Savory Skillet Meals that uses high-quality natural ingredients free from antibiotics and artificial ingredients, flavors or colors.

The interest in fresh frozen also aligns with another key finding from the "Power of Frozen 2021" report. To most frozen food consumers (72%), it’s not frozen or fresh — it’s frozen and fresh. “Mixing fresh and frozen in the same meal is a tell-tale trait of our core frozen food consumers,” said Bodor.

“Shoppers are nearly a year into the COVID-19 pandemic and are having more family meals at home than ever before," added Doug Baker, VP of industry relations at Arlington-based FMI. "They are looking for meal plans, culinary creativity, and convenient, cost-effective solutions. The frozen foods category offers these benefits to shoppers, and that’s why we see all areas — from meal ingredients to meal solutions — reaching new audiences and increasing purchases.”

Poultry and seafood both experienced above-average growth in the frozen food section, which has emerged as a true extension of the meat department. The top three frozen food categories with the largest percentage of dollar growth in 2020, according to Chicago-based IRI, are:

- Seafood (up 35.3%)

- Poultry (up 34.7%)

- Appetizers (up 28.9%)

“It’s not just about what’s for dinner, especially for our core frozen food consumers," Bodor pointed out. "All meal occasions — dinner, lunch, snacks and breakfast — are contributing to an increase in frozen food purchases.”

The "Power of Frozen 2021" identifies megatrends influencing the demand for frozen foods. It was conducted by San Antonio, Texas-based 210 Analytics and is made possible by Pictsweet, Wawona Frozen Foods, J.R. Simplot Co. and Firestone Pacific Foods.

AFFI is the only national trade association that represents frozen food and beverage makers, including manufacturers, suppliers and distributors. Recently, it revealed a new strategic plan to better connect the frozen food supply chain and align with AFFI’s priorities.

Boise, Idaho-based Albertsons operates 2,252 retail stores with 1,725 pharmacies, 398 associated fuel centers, 22 dedicated distribution centers and 20 manufacturing facilities. The company’s stores predominantly operate under the banners Albertsons, Safeway, Vons, Pavilions, Randalls, Tom Thumb, Carrs, Jewel-Osco, Acme, Shaw’s, Star Market, United Supermarkets, Market Street and Haggen. The company is No. 8 on The PG 100, Progressive Grocer’s 2020 list of the top food and consumables retailers in North America.