Speed and Efficiency With Curbside Pickup

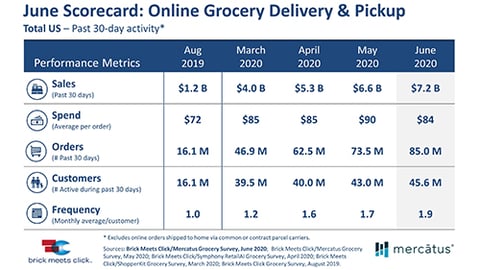

Grocery pickup and delivery have been gaining traction for quite some time, but COVID-19 was the catalyst for e-commerce that no one saw coming. Online sales records in the industry have been shattered month after month, and the number of e-commerce orders have risen to levels that many analysts didn’t expect to see for another five years.

Keeping up with this demand, however, has been far from seamless.

Shopper satisfaction with online pickup and delivery dropped from 80% in 2019 to right around 50% in March, April and May 2020, according to the latest Brick Meets Click/Mercatus Grocery Survey. Customers are less likely to shop the same provider, potentially due to long wait times, an inability to secure a pickup or delivery window, or discontent with out-of-stocks and replacement items.

Key Takeaways

- The COVID-19 pandemic has accelerated consumers’ adoption of e-commerce, with contactless options in high demand.

- Location-based solutions streamline the click-and-collect process by enabling the order to be ready to go when the customer arrives for pickup, regardless of retailer size.

- Vendors are sensitive to consumers’ desire for privacy and have instituted safeguards to protect it.

Food retailers are working hard to enhance the customer experience and streamline operational efficiencies while maintaining enhanced safety measures. To help solve this performance equation, many grocers are looking to technology that helps customers receive their pickup orders as quickly as possible with little to no contact.

“There are statistics out there where if you are waiting under two minutes, you’re four times more likely to come back to do curbside pickup,” says Jeff Baskin, EVP of global sales and marketing for Washington, D.C.-based Radius Networks. “People are demanding a better service, and it has been a wakeup call.”

Improving Speed

Radius Networks’ FlyBuy technology — used by SpartanNash, Giant Eagle, Lowes Foods, United Supermarkets and many others — requests a customer’s location when he or she is en route to the store. Simultaneously, the store staff receives the customer’s estimated time of arrival (ETA) to plan accordingly and ideally meet them at the curb.

“Our goal is we want people to be able to meet them at the curb, because that’s an incredible experience,” Baskin says. “I literally just pop my trunk and I’m on my way.”

Inside the store, retailers can implement a dashboard at the front of the pickup area with arrival times, along with a staff application for whatever mobile device that employees are using to do the picking. These employees could have the app running in the background and get the same alerts that the central dashboard shows when a customer is a certain time away and when they pull into the parking lot.

The Radius Networks solution can integrate with a retailer’s existing systems and consumer-facing app, as well as any other systems it may be using for e-commerce ordering and picking.

“It’s completely seamless for the staff as well,” Baskin says. “Depending on who we’re dealing with, operationally we have a lot of different flow and functionality that really leads to good, efficient operations, which at the end of the day is key for these grocers right now.”

Toronto-based Mercatus recently launched its Mercatus Enhanced Fulfillment solution, which speaks to how the ecosystem can work together to improve the grocery pickup experience. The solution combines ShopperKit’s fulfillment technology with Radius Networks’ location-based communications.

From a customer standpoint, these location-based technologies require little to no effort on their part. Customers temporarily share their location only when they’re using the app.

“We don’t want the customer texting and driving. We don’t want them checking their phone, because that’s just not right,” says Cami Zimmer, chief business officer for Seattle-based Glympse, whose location-sharing technology is used by the likes of Albertsons. “We shouldn’t be making the customer do anything other than provide a seamless experience and a personalized experience, because that’s just what they expect today.”

Making Transactions Contactless

Safety concerns are at an all-time high for employees and shoppers, and many are choosing click-and-collect options so they don’t have to shop inside a store. Location-based and integrated technologies can help make pickup a touch-free experience.

San Mateo, Calif.-based predictive arrival company Rakuten Ready released a “Playbook for Creating Contactless Experiences” in June. In its research, Rakuten Ready found that contactless protocols ranked No. 1 with customers as most important to feeling safe while shopping.

The company’s three pillars to contactless are digital first, customer-centric preparation and contactless handoff.

“In order to keep employees safe and in order to keep customers safe, there’s tremendous interest in demand both from the consumer side and from the retailer side in implementing contactless pickup,” says Jaron Waldman, CEO and co-founder of Rakuten Ready. “Whether you’re using our technology or not, we’re having a lot of really great conversations with people who are struggling to scale out these programs. It’s bigger than just our technology.”

Waldman, formerly the lead of Apple’s geo team, knows a thing or two about location, and he brought much of the Big Tech company’s team with him in the early days of Rakuten Ready, formerly known as Curbside.

Rakuten Ready gives its partners extremely accurate measurements of how long customers are waiting, with the aim of improving customer satisfaction — Waldman says that its research shows that people who wait longer than 10 minutes are less than 15% likely to come back — and operations.

“Retailers will do a lot of work to stand up a click-and-collect program, but then there are operational issues that either they don’t train the staff properly or they don’t staff it appropriately,” Waldman says. Rakuten Ready, which works with Kroger and many other retailers, offers visibility into which stores are performing and which ones aren’t, so as to provide operationally consistent and great performance.

Privacy Concerns

Geolocation inevitably can come with some skepticism for consumers who download apps without knowing they’ve allowed tracking at all times. Technologies such as those from Rakuten Ready, Radius Networks and Glympse, however, access a shopper’s location only during a transaction.

“We’re only tracking the customer from when they have shown intent to pick up their groceries, and then we immediately stop locating them when the order has been completed, either by the customer or by the retailer,” Baskin says.

Meanwhile, Rakuten Ready’s user experience team helps retailers explain on their apps the value proposition of location sharing for a great user experience without any selling of customer data.

Mercatus has adopted the California Consumer Privacy Act to get ahead of regulations throughout the rest of the country and has worked with the CEOs of ShopperKit and Radius Networks to keep privacy at the forefront of their companies’ respective technologies.

“I think it’s about convenience first and foremost, with a high degree of security and compliance,” Perrier says. “We understand the need for privacy, the need for allowing customers to opt into certain communications, and a degree of flexibility.”

Ahead of What’s Next

The coronavirus is changing the retail landscape at such a rapid pace that there are a lot of unknowns about what post-pandemic grocery shopping will look like.

“Click-and-collect was already growing faster than delivery as a channel before COVID,” says Waldman. “Obviously, the rate of growth over the last few months has been huge, and it’s hard to keep up with, but I think even post-COVID, we’re going to go back to a world where some of that traffic is going to go back inside the store and shop the traditional way, but it’s going to be a real accelerator for click-and-collect overall.”

Glympse has been working with grocers specifically on the pharmacy side of the business for “Uber-like” prescription deliveries, in which customers can track their driver and make sure to be home for the delivery.

Predictive arrival technology is also becoming more accessible for smaller food retailers.

“In the past, we may have focused mainly on larger-enterprise companies. It was just easier for us to do that. But now, especially in grocery, we have the ability to service and/or help companies of any size,” Zimmer says. “Small to medium-sized businesses are the sweet spot, because they might not have been quite as far in their curbside planning as the larger companies, and they are needing and looking for something.”

Rakuten Ready is also opening up its technology to smaller retailers with the launch of its Arrive app, which can act as a grocer’s native app for those without one.

“We want to be able to open the ability to know when a customer is coming to a lot of restaurants and retailers that are never going to have their own app,” Waldman notes.

“That is usually the second conversation that we have with grocers, such as, ‘Hey, I’d love to be able to locate customers when they’re in a specific aisle and make sure that they have their loyalty card-specific products, or they’re at the deli counter, and I want to make sure that they can get a Boar’s Head promotion, or something like that,” Baskin explains.

The Supplemental Nutrition Assistance Program (SNAP), once known as food stamps, has also made huge strides during the first half of 2020. Gradual rollout plans of online SNAP have been replaced by much more expedient efforts, and more retailers are working with the U.S. Department of Agriculture (USDA) to accept SNAP Electronic Benefits Transfer (EBT).

Mercatus is about to release SNAP EBT with its fulfillment solution, allowing recipients to pay for a large portion of their groceries using the government program.

Giving people more ways to shop for their groceries is the main reason that geolocation technologies are gaining traction. Retailers can increase speed of fulfillment, smoothe the customer experience with no contact, add additional pickup spots and ultimately keep up with the e-commerce demand that doesn’t appear to be slowing anytime soon.