Cracking The Code: NIQ’s Deep Dive into the Empowered Omnichannel Consumer

Armed with omnichannel choices, shoppers continue to steer purchases to online. But today’s consumers are shopping differently, and the industry is about to be altered by the emergence of Gen Z consumers.

That’s according to a recent webinar, “Cracking the Code – Connecting With the Empowered Omnichannel Consumer,” moderated by Progressive Grocer Editor-in-Chief Gina Acosta, who was joined by NIQ’s VP, omni industry leader Kenneth Cassar, and VP of Omni Solutions Stacey Maniscalco.

In the wide-ranging discussion, the experts alerted retailers and suppliers that Gen Z – not yet in its full spending stride – will ultimately have a profound impact on a market already characterized by a myriad of players and options.

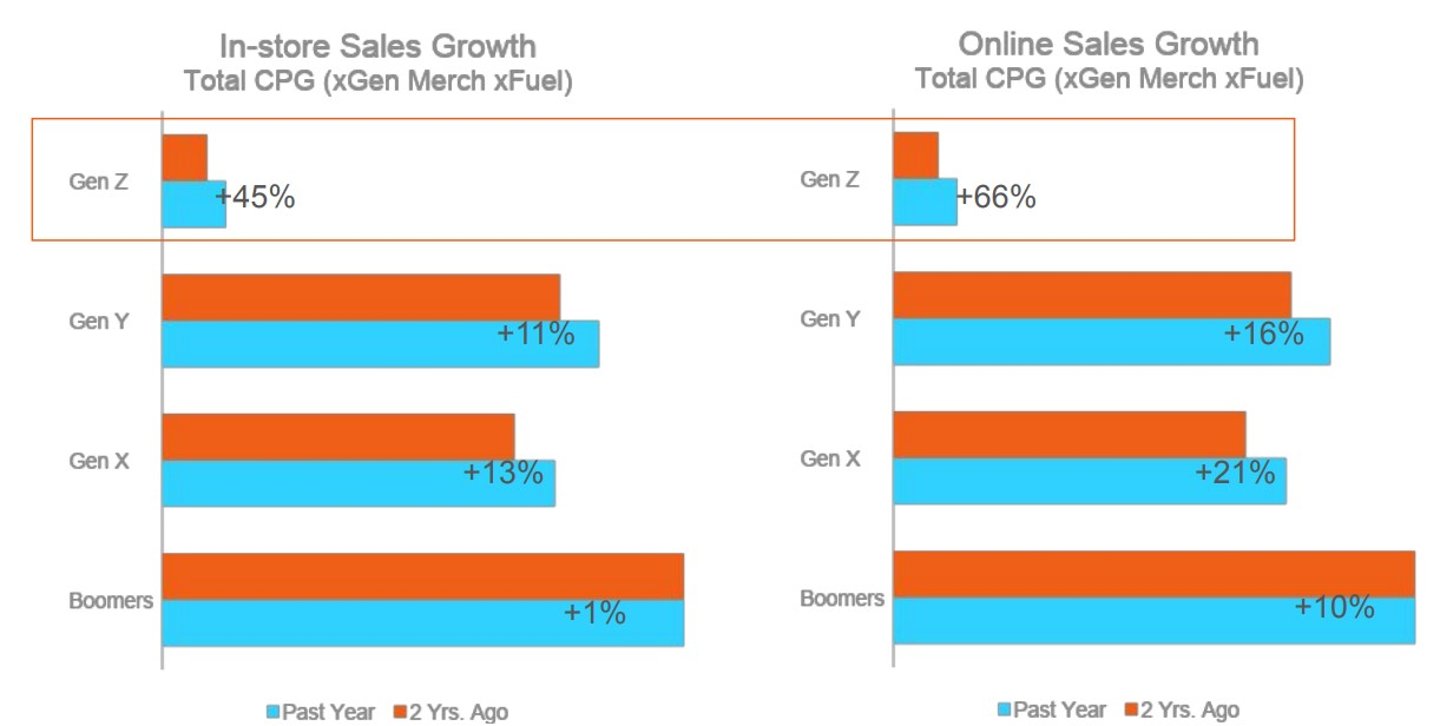

“Sales are increasing significantly for this particular generation, [and] they’re growing faster online than offline,” said Cassar of the digitally native generation. Just give it five years, he suggested, and the cohort’s spending will mature to game-changing levels.

Maniscalco agreed: “They are the future of the marketplace, and they’re starting to influence … trends and behavior changes.”

A key point, Cassar added, is that, while for the Total Consumer Panel’s online sales, Amazon’s share is currently 40%, the giant online retailer’s share for Gen Z alone is a full five points lower.

Those points were distributed over the online volume of the likes of Walmart, Target and other channels. The implication: Gen Z may well help turn today’s already fragmented retail landscape into even more of a free-for-all.

Maniscalco and Cassar expressed a high level of confidence in their analysis, due to the quality of the data. “Today at NIQ, we have a total panel size of 1 million panelists,” said Maniscalco, “and then we select the best-of-the-best 100,000 to make it into our longitudinal youthful panel that we and our clients use.”

She added that NIQ uses a multilayer approach that provides much greater detail and provides a truer picture of what’s actually occurring in the marketplace, including online.

One of the most important takeaways from the data is that online sales have continued to expand rapidly from the COVID peak. Online food sales, for example, have in a recent period expanded by 22% year over year, twice the in-store rate of growth.

Household care online sales climbed 20%, five times the growth percentage that this product classification achieved in-store. As a result, the online share of all omni sales in the past year was 16%, compared with the peak COVID share of 15%.

“It's a relatively modest increase of about a point,” said Cassar, “but it is still an increase since peak COVID, when in many cases we had no choice but to buy online.” The implication: Online buying has moved from necessity to choice and continues to grow.

The NIQ data provides a more nuanced understanding of this growth. It is, for example, not due to greater household penetration; that, in fact, has stabilized at levels slightly higher than those at the peak of COVID. Over the past year and a half, household penetration for online food purchasing has hovered around 59.0% to 60.2%. The penetration level at peak COVID was 53.7%.

For online HBC sales, household penetration since the beginning of 2022 has stayed around 74% to 75%; the peak COVID level was 72.2%. Growth, explained Cassar, has flowed from rising buying rates.

Relative to food, online buying rates have climbed from $406 at peak COVID to $612 currently. HBC tells a similar story: online buying rates went from peak-COVID $207 to $364. Behind this trend, the growth in occasions per buyer has increased. For example, the online rate of gain for total CPG was 7%.

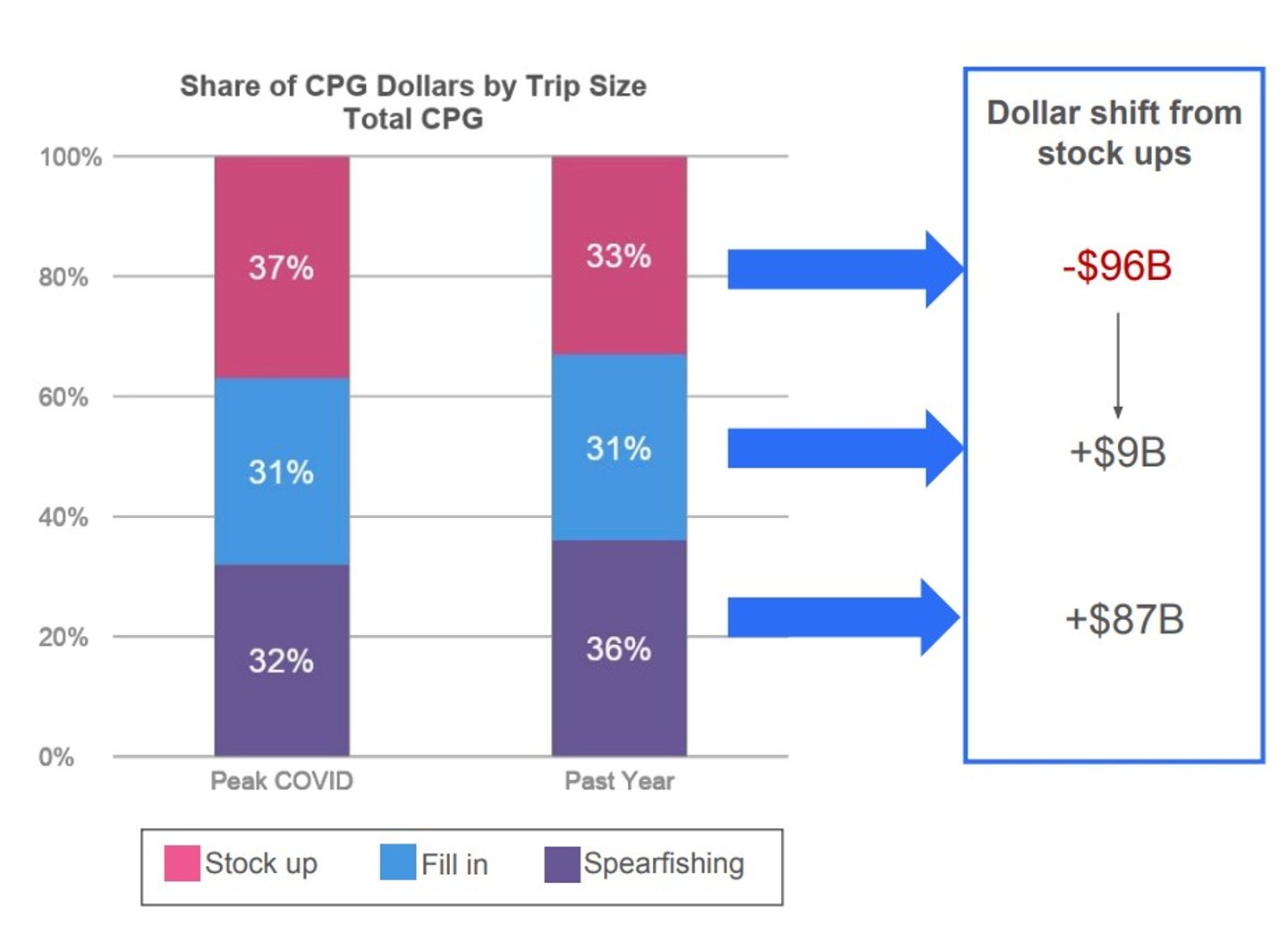

At the same time, the webinar presentation noted that “after COVID, consumers reverted to their fragmented ways.” In-store went one way, online the other. In-store, stock-ups (purchases of 12 or more items) are down six points, while fill-in (purchases of four to 11 items) and spearfishing (purchases of one to three items) trips are up substantially. Online, however, COVID peak and post-COVID are virtually the same, at 14% stock-ups, 26% fill-ins and 60% spearfishing trips.

Nonetheless, the decline in stock-up trips in-store, and their relative unimportance in online purchasing, is a measure of the fragmentation that the CPG retail market is undergoing.

Cassar’s take was that this development goes back a long way pre-COVID. He cited as examples the growth of the club channel for larger purchases and the proliferation of the dollar stores for cherry-picking. A further step, he added, is that COVID introduced many shoppers to new channels online. The result has been consumers more comfortably exercising options regarding trip purpose and channel selection than before.

“Essentially,” Cassar summed up, “the empowered consumer [is] taking advantage of the channels that they could for the things that they wanted to buy, without the obligation to purchase everything from a small number of retailers.”