EXPERT COLUMN: Simplifying the Retail Experience of ‘Nutraceuticals’

Nutraceuticals retailing is broken. For simplicity, let’s define “nutraceuticals” as nutritional supplements, arguably the most visible and well-defined category. By “broken,” we mean that the nutraceutical shopping experience is unpleasant and difficult for consumers and doesn’t live up to its profit potential for retailers.

Consumer Perspective

The supplement aisle presents the consumer with a dizzying array of ingredients, dosages, form factors and brands. Rough observation suggests there are about 700 SKUs in a typical CVS/Walgreens/Rite Aid. It’s unrealistic to expect the typical consumer with no background in pharmacology or nutrition science to make sophisticated decisions in this context. In our research, we’ve found that consumers deal with this complexity by boiling the purchase decision down to one factor: price (what is the lowest cost per bottle, per tablet, etc.). Consumers do this instead of trying to balance other factors such as brand, quality, absorbability and other areas in which manufacturers have made significant investments.

Retailer Perspective

While we believe the supplement category is inherently attractive, we also believe that it currently underdelivers for many retailers. In both the grocery and drug channels, we’ve observed that most of the volume is sold on promotion, much of which is at the full BOGO level. We’ve also found through our research that the supplement category is generally price-inelastic (lower prices don’t drive a correspondingly larger volume of consumption; there are dosage limits on consumption capacity, unlike most food and beverage categories). Hence, the lowering of prices through aggressive promotion destroys value for retailers and manufacturers.

The Solution

What can retailers do to fix the nutraceutical category? We think it boils down to simplifying the experience and empowering the consumer:

- Simplify: By simplifying, we mean making the aisle more approachable. This might involve some editing of the assortment, but more importantly, making the layout more need-oriented, as consumers ultimately are looking for a benefit such as general wellness, bone health or immunity, and not an array of chemicals. GNC, Whole Foods Market and many smaller chains in the health channel already do this. Mainstream grocery and drug chains are still primarily brand-/ingredient-focused and can do much better.

- Empower: This goes back to basic retailing. Right now, the consumer only has price as a discriminator. What retailers need to do is to give consumers the tools to better understand the good/better/best of the supplement category so that they can actively trade off features and benefits with price. Again, Whole Foods is one example of how to approach this, by staffing the supplement aisle with an expert who can explain the details of different products. Unfortunately, this model is expensive and not practical for most mainstream retailers. However, there are solutions like signage and mobile technology that are likely more practical.

Potential Model

Are there models in other categories that can be applied to the nutraceutical category? We think there are. Specifically, specialty retailers in both the home improvement and wine/spirits categories potentially provide great analogies. Like supplements, both categories are complex for the consumer — the home improvement category presents consumers with a vast array of tools and consumables that need to be combined in the right mix for specific projects, while the wine/spirits category presents consumers with a seemingly endless combination of makers, appellations, varietals, vintages, etc. Also, as with nutraceuticals, the home improvement and wine consumer is varied in terms of technical expertise, from the pro or collector, respectively, to the novice. Specialty retailers have had to deal with these challenges throughout their stores and have developed a number of strategies to enhance the shopping experience.

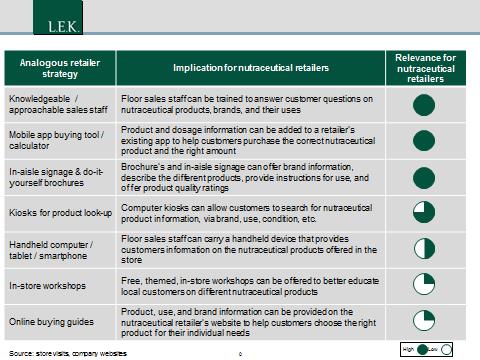

Some of the most notable of these that we have seen are shown in the following chart.

Where to Go from Here?

So where does the grocery or drug retailer go from here? What steps can be taken to improve the supplement category?

1. Get to know your consumer (by relevant consumer segment)

a. Why are they buying from you?

b. Why are they buying elsewhere?

c. What tools are they looking for?

2. Reposition the supplement aisle with a simpler, solution focus

a. Rationalize SKUs to reduce complexity

b. Orient assortment around conditions/benefits

3. Provide your consumer with the tools to make more sophisticated purchase decisions, for example:

a. Mobile apps

b. In-aisle signage

c. Better-trained sales associates

4. Partner with manufacturers

a. Enlist their support in educating the consumer (sponsoring in-store workshops, demo/sample days, etc.)

b. Co-invest trade dollars in consumer education and experience enhancers

5. Rethink promotion and change the conversation with your consumer

a. Change the focus from the volume/depth of this week’s BOGOs to how you can help them make better supplement choices, and ultimately live better lives.

b. Enlist manufacturer support to help fund and make this possible

Alex Evans and Manny Picciola are managing directors and partners at global management consulting firm L.E.K. Consulting.