What Grocers Should Expect From the Red Meat Sector

For products that have been considered commodities for decades, it’s all about the specifics for beef and pork right now. From down-to-the-farm origin details to the best price points to tailored instructions, consumers want the goods on red meats offered by brands and grocers.

The nature of the current retail environment is driving these and other demands for beef and pork, which are also invariably affected by livestock supplies. A 2022 IBM report concludes that “consumers want it all,” and notes that purpose-driven consumers who choose products and brands based on how well they align with their values represent the largest segment of consumers.

[Read more: "Meat Shoppers Polarize Choices"]

Other recent research from FMI — The Food Industry Association and NielsenIQ shows that 80% of shoppers want at least one other indicator beyond ingredients and nutrition information, like certification and claims, allergen information, and values-based details like animal welfare, fair trade and labor practices. Also, in today’s economy, shoppers want to arm themselves with price information to get the best deal possible.

The market for beef and pork, at least in the near term, reflects shoppers’ appetite for specifics.

Sourcing and Storytelling

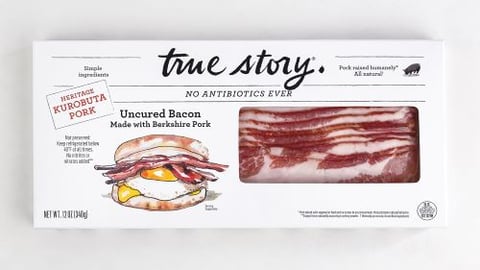

As 2023 approaches, one can expect the trend of storytelling to continue with beef and pork products. That trend began a few years ago, when protein companies added more details about farmers and ranchers on their websites, social media platforms and even on packaging.

Kent Harrison, VP, marketing and premium programs at Springdale, Ark.-based Tyson Foods, confirms that such information resonates with shoppers, especially when it comes to sustainability.

“We know that our independent ranchers and farmers view the land and their cattle/hogs as so much more than just a business — it’s their livelihood, their heritage and their legacy for future generations,” notes Harrison. “It’s our role as a brand to champion American agriculture, and to do so we must increase transparency in our animal welfare practices and sustainability efforts with shoppers. These are topics that consumers care about and influence their purchasing decisions.”

Other beef processors and brands are emphasizing sustainability as they share information with consumers. “Beef producers and brands must consider consumers’ perceptions of sustainability,” asserts Jim Rogers, SVP of sales at Arkansas City, Kan.-based Creekstone Farms Premium Beef. “On an aided basis, almost half of meat eaters assume sustainably raised meat addresses antibiotic/hormone and animal welfare topics. At Creekstone Farms, all cattle can be traced to their ranch of origin, and our team has invested in telling the stories of our cattle producers to help consumers understand where their food comes from.”

In addition to connecting shoppers with producers, meat processors and their retail partners are expanding their portfolios to include products from additional or different sources. Niman Ranch, of Westminster, Colo., for example, recently introduced a USDA-graded 100% grass-fed and -finished beef program, and is touting the products’ sustainability and taste benefits.

The new grass-fed beef is raised by independent family ranchers without antibiotics or hormones and is 100% Certified Humane, an ASPCA-approved third-party animal welfare certification, according to Niman Ranch.

The Weight of Inflation

It’s been a year of sticker shock at the meat case, something that those in the red meat and retail industries hope to avoid in the coming year. The consumer price index for beef in particular led several other food-at-home categories at various points in 2022.

As producers grappled with market dynamics like a drought that affected cattle supplies, volatile hog production, and Russia’s war in Ukraine that drove up feed costs, consumers balanced their taste for red meat with their pocketbooks that pay for it.

Midan Marketing, a marketing, research and creative agency with offices in Chicago and Mooresville, N.C., recently conducted a study showing that consumers still have a penchant for beef — 88% purchase at least some conventional beef products — but are keeping tabs on prices.

“We know price followed by quality indicators, such as USDA grade, are the top purchase influencers when consumers are purchasing beef,” observes Michael Uetz, principal at Midan Marketing. “This is true both for consumers purchasing beef to cook at home and those ordering beef at restaurants. At retail, 64% of beef consumers are considering price either first or second.”

Prices have also edged higher in the pork sector. A report conducted for the National Pork Board showed that retail pork prices spiked 27.3% from January 2020 to May 2022. Earlier this fall, the Des Moines, Iowa-based board suggested ways to incorporate pork into budget-friendly meals, like using smaller portions of lean cuts and choosing lower-cost products like ground pork.

That said, a portion of the shopper base isn’t always trading down to more value cuts for beef or pork. “At the retail meat case, price concerns do not always translate to consumers purchasing less premium meat,” points out Creekstone’s Rogers. “One of the few times when retail price will matter less is when the consumer is already trading down from dining out at a restaurant to eating at home. For these occasions, consumers have already made their budgetary decision and are seeking an elevated eating experience.”

That brings the discussion back to price versus value in the meat case, a push-pull that will likely continue in 2023. “’Value’ is the name of the game now, but not all shoppers define value in the same way,” explains Uetz. “While there will definitely be more shoppers focusing on grinds and multi-meal roasts to get the best value, there will also be others experiencing less economic pressures who continue to define value as USDA Prime or Wagyu or beautiful ribeye steaks. These shoppers are looking at creating a restaurant experience at home, for less. Focusing only on low-cost value will have producers leaving money on the table.”

According to Rogers, there’s plenty of opportunity between the lowest-cost cuts and the most premium choices. “Identifying budget-friendly options like strip loin roasts as alternatives to ribeye roasts can keep consumers within the beef category and help them enjoy the flavor and quality they know and love,” he says.

Supply Side Outlook

Given the nature of cattle and hog production, the supply outlook will help guide food retailers’ expectations for beef and pork going into 2023. The U.S. Department of Agriculture (USDA) recently projected that the production of proteins in the United States, including beef, pork, chicken and turkey, will decline by 1% next year compared with 2022.

As retailers navigate market shifts stemming from external factors like livestock supplies, inflation and other socioeconomic curveballs that may be coming, they’re working with suppliers who are keeping pace with consumer interests and demands. At Tyson, Harrison notes that the company has continued to invest in automation, technology and safety enhancements, including a $300 million project at its case-ready plant in Eagle Mountain, Utah.

- The Market for Alternatives to Traditional Red Meats

In the much-buzzed-about plant-based space, R&D efforts continue. Plant-based protein company Beyond Meat, of El Segundo, Calif., recently added a new plant-based steak (see page 97 of Editors’ Picks), and a Vancouver, British Columbia-based company, Urbani Foods, has rolled out Misteak, a vegan ribeye-like steak. Meanwhile, Redwood City, Calif.-based Impossible Foods’ newest product is meatless Impossible Pork, containing 18 grams of protein, with 59% less total fat compared with 70/30 blends of ground pork.

Still, meat alternatives and analogs aren’t taking over grocery cases anytime soon. Beyond Meat, for its part, did turn in growth this year, but at a less-than-expected rate, and its stock slid. Major meat processor JBS USA, based in Greeley, Colo., revealed that it’s shuttering its plant-based meat business, Planterra. Also, the 2022 “Power of Meat” study, conducted by 210 Analytics on behalf of FMI — The Food Association, shows that only 9% of consumers are eating plant-based meat alternatives weekly.

What about cell-based meats? The “Power of Meat” report indicates that 40% of consumers are unwilling to try cultivated meats, but the category did get a push forward with the mid-November clearance approval of lab-grown meat by the U.S. Food and Drug Administration.