What Brands Are Excelling in Category Management?

The pandemic may be finally behind us (fingers crossed), but the grocery retail landscape is still proving difficult to navigate as operators grapple with such problems as lingering supply chain snarls and surging prices due to record inflation. In such a climate, those brands that have stepped up to provide trusted guidance on how to keep sales growing not just in their particular categories — even relatively mature ones — but also throughout the store, have emerged as retailers’ staunchest allies in generating hard-won profits.

Whether by creating attractive in-store displays, rolling out smart cross-merchandising initiatives, launching effective traditional and digital marketing campaigns, developing on-target new products to meet evolving customer needs, or sharing impactful advice based on carefully gathered consumer insights, the 19 brands profiled below refused to let category and total-store sales slide, choosing to work with their retailer partners to make a real difference in the aisles.

[Read more: "100 Iconic Brands That Changed Grocery"]

Based on their submissions detailing the various ways that they helped retailers succeed despite the many real challenges encountered by food manufacturers and sellers over the past year, Progressive Grocer chose those brands whose efforts in this space our editors deemed the most impressive. Read on to find out just how each of the 19 companies profiled below earned its well-earned spot as a 2022 Category Captain.

Abbott

When a national retailer was experiencing a market share gap in the oral electrolytes category, Abbott shifted strategy to capitalize on the latest shopper trends, providing recommendations to drive category growth and market share.

Abbott conducted consumer research to understand purchase intent and incrementality to the category. What it found was that the oral electrolytes category is a growth segment, with a 14.6% five-year growth projection, and that the pandemic accelerated the importance of hydration, immunity and health. With a substantial 80% of consumers worried about protecting their immunity, shoppers expect to find oral electrolytes in three to four locations in the store, based on need state. Abbott further discovered that immunity-focused brands saw a 190% increase in sales during COVID, that one in five shoppers have tried a new product due to health messaging, and that 32% of oral electrolytes users want benefits beyond rehydration.

Based on this research, Abbott proposed the following strategy to the national retailer: Add incremental/relevant innovation to the oral electrolytes segment and de-seasonalize immunity. The product being researched was differentiated with added zinc and magnesium for immune support, but with the trusted power of Pedialyte to hydrate. Shopper activation consisted of a digital approach to reaching parents and adults seeking cough, cold and flu solutions during the key Q1 and Q4 time periods. The plan included on- and off-site digital media and banners communicating the key benefit of immune support to shoppers. Placement was in the health-and-wellness section, reaching shoppers focused on proactively boosting hydration/immunity or on using immune support products while sick.

In July 2021, two Pedialyte Immune Support products launched at the national retailer, along with the strategy. As a result, the national retailer gained 4.1 points of market share in the pediatric digestive health category, expanded oral electrolytes usage occasions and brought new users to the category.

Further, the targeted media activation garnered a $2.11 incremental return on investment for the brand, a 16% sales lift and 49% new buyers to the brand. Perhaps most interestingly, unaided social media impact from influencers on Instagram and Twitter drove an 18% lift in brand sales.

Anheuser-Busch

Over the past several years, the alcohol industry has seen significant shifts in consumer and shopper preferences blurring the traditional categories of beer, wine and spirits. This shift started with flavored malt beverages and then progressed to malt-based seltzers, and now to wine and spirit-based seltzers. These significant changes in consumer demand have created complexity for shoppers and retailers alike with the emergence of a fourth category.

Anheuser-Busch has led the conversation in defining this new category, creating a framework to analyze it and introducing recommended merchandising guidelines for retailers to effectively grow these products. A-B spent hours talking to people to define the new category, which has been dubbed “hard beverages.” People define the term as fully formed alcoholic drinks generally not exceeding 20% ABV in a convenient option. Flavor is the primary attribute, with a range from light to flavorful across various dimensions of carbonation, alcohol taste and drink profiles.

After A-B polled consumers to define hard beverages, the company created a category expansion framework to analyze and provide insight into growth trends, innovation white space and merchandising recommendations.

Starting with the understanding that this area is huge — $9.4 billion over last year — and that the growth is 24% incremental to alcohol, the hard-beverage space creates the opportunity to manage this complexity as a new category.

A-B also researched how shoppers interact with hard beverages to create a set of merchandising guidelines for retailers. Key principles include providing a unified location for hard beverages of any malt, wine or spirit base; merchandising adjacent warm and cold beverages together; and focusing cold placements on top brands with the highest rates of sale.

Using this research, A-B has worked with several retailers to bring these recommended strategies to life. A major national grocer that reallocated cold wine space to hard beverages has seen 130% growth in spirit-based hard beverages. A regional grocer that reflowed its sets to put hard beverages first in the flow has seen dollar sales grow 8% in the latest year. Also, a major national mass retailer implemented a new buying structure to reduce the complexity across traditional beer, wine and spirits responsibilities.

A-B continues to integrate these insights and recommendations into Ignite, its retail category strategy, to continue advising retailers on how to effectively grow the alcohol category. In fact, the company has leveraged both established industry research partners and cutting-edge providers to inform how the alcohol and beer category will grow.

As COVID waned and inflationary pressures grew, A-B led the conversation with the industry in terms of consumer insights, evolving occasions and shopper behaviors. Off-premise category growth has largely held from COVID, but consumer demand and shopping behavior have begun to shift. A-B brought new insights and recommendations to retail to help capture growth. The waves of growth from craft to seltzer, and now to spirit-based hard beverages, are beginning to shift again into the next wave of affordable options for shoppers.

A-B recommended to a large regional grocer a proactive shelf space allocation that has contributed to 0.9 points of market share growth. Retailers continue to drive traffic through remodels in their alcohol departments and are adding more space to meet the elevated demand. A-B continues to enhance alcohol macro-space insights and recommendations to find macro-space opportunities and understand alcohol’s role within the context of the total store. A major national grocery retailer has leveraged these recommendations to add about 10 feet of additional alcohol space to its remodels, beginning in late 2022.

Additionally, the online alcohol category continues to see growth. A-B has continued its work with retailers and to make recommendations to drive online growth leveraging Ignite omni-fundamentals and growth drivers on the shifting online shopper. This year, A-B evolved its proprietary eRetail scorecard system to encompass 46 benchmarks, launching with national grocers to identify opportunities that spur online loyalty and sales.

Innovation has been a focus for A-B over the past year, with new products shaped by the macro-trends of premiumization, health and wellness, flavor, and the value equation. The company’s innovation has helped increase category growth in the grocery channel. One example is the launch of Bud Light Next, the first national zero-carb light lager.

Additionally, A-B launched The Vault in 2021, a one-of-a-kind collaboration center where it’s designing the future of total alcohol. In The Vault’s first full year, A-B hosted 15 retailers across grocery, mass, drug and convenience, each visit highlighting trends in regard to consumers, occasions and the alcohol industry, with specific opportunities for growth via macro-space planning, meals programming, hard beverages and category capabilities.

Challenge Dairy Products

Challenge is laser-focused on moving the overall butter category forward for retailers and end consumers. As the largest butter manufacturer in the United States, it delivers upwards of 50%-70% of the total butter category for retailers between its Challenge and private brands, with an emphasis on driving incrementality.

While the butter/margarine category grew 19% during the pandemic as people rediscovered the joy of baking, the team at Challenge Butter was behind the scenes working to reimagine the future of butter in a post-pandemic world to ensure continued growth. Through extensive primary shopper research that took the Challenge team into the homes of butter consumers, the company discovered a huge opportunity to expand usage occasions beyond breakfast and dinner. Another key learning was the need for the category to appeal to younger demographics.

Challenge’s research also uncovered that consumers shop the category through the lens of six subsegments. By understanding the distinct role of each segment, the company identified opportunities to drive new usage while simultaneously appealing to new consumers.

This research influenced retailers to re-evaluate the category for the first time in decades. The most underdeveloped segment was flavor, previously an afterthought in innovation and assortment decisions. Challenge seized the opportunity by introducing six Butter Snack Spreads in dessert and seasoned varieties. By delivering a 45% increase to basket size, Challenge Butter Snack Spreads enable retailers to capture incremental value among butter shoppers.

Within the category’s finite space, a distinct merchandising strategy was essential to deliver on consumer needs and to capture growth. Challenge Butter Snack Spreads were the first spreadable butter varieties to be available in shelf-ready packaging, adding efficiency for retail workers at a time when labor challenges were escalating. Another first for the category was a fun augmented-reality experience for consumers through a QR code on the product lid to drive deeper consumer engagement, in addition to online shopper marketing efforts.

These unique snack spreads and creative initiatives have propelled Challenge into the position of a leading innovator in the butter category, bringing excitement, flavor and quality offerings that push the boundaries of the dairy case.

Chiquita Brands

With the pandemic uppermost in consumers’ minds, and new habits engraining themselves into daily life, consumers’ willingness to adopt a healthier lifestyle only grew stronger. Chiquita took this opportunity to own the breakfast occasion by promoting cross-category consumption and reinforcing the position of its bananas as a breakfast staple.

Although breakfast is recognized by many as the most important meal of the day, various expensive options make a balanced, nutritional breakfast seem out of reach for families. Leveraging the position of cereals, yogurts and bananas as healthy breakfast classics, Chiquita teamed with General Mills on the Go Bananas for Breakfast campaign to highlight that good nutrition can be affordable.

On average, a bowl of any General Mills Big G cereal with a Chiquita banana and an Original Style Yoplait single-serve yogurt costs a little more than $1, making it one of the most affordable and nutritious breakfasts around. Thus, from Jan. 1 to mid-April 2022, Go Bananas for Breakfast offered an easy-to-prepare, nutritious and affordable breakfast bowl with all three brands in a limited-time offer to save up to $6 via on-pack coupons and a digital rebate.

The breakfast bowl combination aimed to address the finding that most Americans don’t consumer the recommended daily amounts of whole grain, calcium, vitamin D and potassium, according to the 2020-25 Dietary Guidelines for Americans. By incorporating all three foods into one breakfast, Chiquita and General Mills help fuel consumers with three of the five recommended food groups — grain, fruit and dairy — delivering 12-plus grams of whole grain, 30% of the daily value of calcium, 25% of the daily value of vitamin D and 15% of the daily value of potassium.

To reach its audience, the campaign used linear and online TV ads, programmatic and YouTube ads, and a robust social media campaign. To raise awareness of the campaign in-store, Chiquita built its presence outside of the produce section with point-of-sale materials in the cereal and yogurt aisles of key retailers.

In stores where both Chiquita and General Mills were present, IRI logged a 2% dollar sales increase versus 2021.

The Coca-Cola Co.

As an iconic 136-year-old brand, The Coca-Cola Co. is consistently looking for ways to deliver exciting innovation to consumers who are familiar with the brand, while investing in the refreshment of future drinkers. Developed under the successful Real Magic brand platform, Coca-Cola Creations launched in February 2022, seeking to drive engagement and relevance with Gen Z by quenching their thirst for discovery through unexpected beverages and packaging designs, culturally relevant expressions, and creative collaborations.

Coca-Cola Starlight and Coca-Cola Starlight Zero Sugar hit shelves in the United States in February 2022 as the first limited-edition flavor offering from the global innovation platform Coca-Cola Creations. Appearing on the market for about six months, the Starlight beverage was inspired by the infinite possibilities of space, fusing signature Coca-Cola taste with unexpected touches like a new reddish hue. Coca-Cola Starlight also boasted a novel packaging design featuring a multidimensional light-filled star field.

With the private space exploration sector seeing $366 billion in revenue in 2019, as reported by the Harvard Business Review, Starlight created a category solution by leveraging the outer-space curiosity of Gen Z. Throughout its limited release, Starlight generated $225 million in incremental dollars to the sparking soft-drink (SSD) category, based on data from Numerator and Nielsen. This was largely achieved by expanding existing drinkers’ consumption while also recruiting Gen Z into the category with the aim of haloing across core Coca-Cola brands.

Positive results for Starlight were realized early on: Walmart pre-order product completely sold out in one day, resulting in the highest one-day unit sell for The Coca-Cola Co. on Walmart.com.

“Walmart is leaning in,” notes Todd Wetmore, merchandising director of carbonated soft drinks at the retailer. “We deem [Starlight] as the [SSD] category’s No. 1 innovation item for Q1.”

To connect further with trendy Gen Z consumers, Starlight also became the first Coca-Cola product to debut on the popular livestreaming platform Twitch. Starlight also harnessed the power of Gen Z influencer culture by creating bespoke boxes that articulated the full magic of the Starlight experience. The campaign was anchored by a partnership with global pop star Ava Max that featured an augmented-reality “Concert on a Coca-Cola” experience available exclusively by scanning a Starlight can.

The launch of Starlight has no doubt proved successful for Coca-Cola Creations, with the products generating $57 million in total year-to-date sales, and 50 million bottles and cans sold, according to Nielsen. Starlight created a strong, positive halo around the Coca-Cola brand, with 78% of previous non-Coca-Cola purchasers having purchased another Coca-Cola product since buying Starlight.

With additional limited-edition beverages already in the works, Coca-Cola Creations is poised to introduce more innovative products and experiences across the physical and digital realms.

Dole

It was a challenging year for produce, thanks to such headwinds as supply chain disruptions, inflation, and consumer trends toward indulgent foods. Dole’s category leadership rose to meet the challenges, providing strategic direction to retail to re-engage lost buyers, optimize promotions, and implement winning pricing, merchandising and marketing strategies.

Inflation has affected shopper behavior, causing trade-down within the value-added salad category and switching out to commodity vegetables. One example of this includes Dole partnering with a national retailer to regain kit buyers, leveraging a $1-off-a-Dole-kit promotion.

The promotion drove a 25% increase in households buying a Dole kit and a 5% increase for any kit, along with 22% dollar sales growth for Dole kits and 4% growth for any kit among households that hadn’t purchased a kit in the previous 12 weeks during the promotion period. Results remained similar after the promotion.

Also, higher average retails on shelf in 2022 wreaked havoc on retailers’ promotional strategies. Dole partnered with a large Midwest retailer, using its historical elasticity coefficients through Nielsen’s Revenue Management and Optimization (RMO) portal to project the impact of adjusting everyday chopped kit pricing from $3.99 to $4.19 and promoted pricing from $2.99 to $3.14. The projected results showed a 5% increase in dollars, with little impact on unit sales, and a 5.3% increase in net revenue. Actual results proved better than projected promotional outcomes for the retailer, with an increase of 25.1% in dollars, 6.3% in units and 30.9% in net revenue.

Finally, organic continues to be the fastest-growing banana segment and the best means to drive organic volume in the produce department. Dole worked with a retailer to increase conventional pricing, narrowing the price gap to organic and fueling trade-up. In addition, Dole identified stores in which to deploy secondary display racks and marketing tactics to boost banana awareness and consumption. These actions led to organic dollar growth of 17.6%, versus run-of-market growth of 0.7%, without cannibalizing conventional — 4.3%, versus 2.0% run of market — and increased total banana revenue of 5.3%, versus 1.5 % run of market.

Activating these pillars, Dole stepped up collaboration to reach new heights in retail partnerships, enabling those retail partners that heavily depended on the company’s category development team to add between three and four points of growth ahead of their competitors.

E&J Gallo Winery

You might say that E&J Gallo Winery thought outside the box when it came to making a play for sales. To capitalize on growth in the 3-liter (3L) box wine segment — which has been propelling overall wine category growth sales and outpacing the leading 750-milliliter and 1.5-liter sizes — the wine company teamed up with the National Cattlemen’s Beef Association on a Game Day Ready joint promotion in early fall 2021.

The MVP of the program was Gallo’s Black Box brand of 3L boxed wine. The No. 2 brand in its package class, that variety was up 9.9% in sales on a year-over-year basis and came in as the sixth overall wine brand in sales in the United States, according to Gallo. The Black Box portfolio encompasses Cabernet Sauvignon, Chardonnay, Pinot Noir and Pinot Grigio, sold in shatterproof and resealable boxes.

The wines were positioned as an adult-beverage choice for watching the game either at home or at a tailgate party or other celebration. Through the promotion, shoppers could score dual-purchase coupons for the product and for $5-off beef items.

As intuitive as the pairing of wine and beef seems, Gallo confirmed the potential of the program by targeting consumers who overindexed in watching professional football, baseball and basketball games while enjoying their favorite beef recipes and wine.

To kick off the promotion in eye-catching style, the company developed point-of-sale display materials that included a 3D pricer frame, an end cap kit, and a saddlebag kit featuring both Gallo and beef logos. A modified flex kit was also available, containing enough materials for three displays: a 36-foot roll, three oversize pillow signs and up to 15 price shelf talkers. Digital was part of the mix, too, through digital coupons and a QR code that enabled shoppers to enter a sweepstakes to win game-day essentials.

Many participating retailers cruised to a win with this joint promotion. One retail customer reported a 59% lift in total basket sales when Black Box was included, while that store’s meat category experienced its highest repeat purchase rate of the year. Black Box display sales at the location rose 34% and, significantly, drove a 63% increase in new shoppers entering the 3L box wine category.

The cross-category promotion aligned with Gallo’s recent investments in sporting events. In 2022, the winery became the new official wine sponsor of the National Football League, which attracts up to 180 million viewers.

On a parallel track, Gallo is beefing up its Black Box line. Earlier this year, the company introduced its Savvy Man spokesman, portrayed by actor Adam Scott, in a new campaign. The brand has also rolled out new varieties, including Buttery Chardonnay, Tart & Tangy Sauvignon Blanc, Vibrant & Velvety Red Blend, and Deep & Dark Cabernet Sauvignon.

Flowers Foods Inc.

What happens when one of the most basic grocery staples meets advanced grocery tech? In a reflection of the growing power of data in the retail and CPG industries, Flowers Foods recently saw an uplift in sales of traditional sandwich bread after deploying data tools to determine the best price points and events at one of its retail customers.

Flowers, a major player in the commercial bread category, tapped cloud-based artificial intelligence (AI)-powered solutions provider SymphonyAI Retail to gauge the effectiveness of its promotions at a time when consumers have been feeling pinched by inflation and other circumstances. The baked goods manufacturer used SymphonyAI Retail’s Shopper Card data systems tool to assess shopper behavior during special promotional events at a major retailer’s stores in the Southern California region. Traditional sandwich bread was chosen as the assessment target, because that item is a crucial part of the sector, accounting for more than one-third of the category’s volume.

The results were, indeed, a slice of shoppers’ lives: The data helped Flowers better understand how consumers react to a specific event. Among other findings, the information revealed whether shoppers were new to the brand or switching from another brand. Flowers was also able to determine whether its most valuable customers were engaged in the promotional effort and whether people were increasing their consumption.

Having such data in hand confirmed a meaningful return on promotional activity investment and verified that Flowers was on track in the commercial bread category. As the company points out in its Category Captains submission, “In the current inflationary environment, it is imperative to maximize promotional effectiveness which helps retailers, vendors and consumers offset inflationary pressures.”

From a numbers standpoint, follow-up data showed that dollar sales of traditional loaf bread at the participating stores grew 8.7% and increased market share of the SoCal market area by 24 basis points. The number of baskets and household counts increased by 2.7% and 2.9%, respectively, for the overall segment. As for ROI, the percentage of profitable promotions rose from 26% in the prior year to 44% after implementation.

Further, learning more about how people shop for traditional bread can go beyond one brand’s lift. According to the data gleaned by Flowers at the major retailer’s stores, the improved ratings metrics benefited all brands in the commercial loaf bread space.

Flowers remains a formidable player in the commercial bread category. The company recently reported that it has outperformed the total bread category for the total United States on a year-over-year basis, with an 8% lift in dollar sales versus the overall market. Flowers produces private label breads, as well as branded products under the names Nature’s Own, Dave’s Killer Bread, Wonder, Canyon Bakehouse and Tastykake, among others.

Fresh Express Inc.

As inflation has taken a bite out of many food categories, shoppers are responding by switching up what they’re buying and eating. That’s true in packaged salads, too, where there has been a bit of shifting going on.

Fresh Express switched gears along with, and, in some cases, ahead of, price-conscious consumers looking for healthy, convenient plant-based nutrition. Following an extended period of strong sales as consumers mostly ate at home, growth in the company’s value-added salads finally slowed a bit in 2021, due to price increases related to fuel costs, supply chain issues and labor challenges, among other market factors.

Heeding the trend and recognizing consumers’ new mindsets, Fresh Express focused its category management efforts on the impact of inflation. For example, the company suggested a promotion update from a three-for-$12 offer to a two-for-$8 offer to stay relevant. In addition, Fresh Express shared information with its retail customers on the slowing growth of premium salads and pointed out the uptick in sales of classic salad varieties.

As shopper interest in private label products intensified during inflationary times, the company also supported sales of its Fresh Express brand. The recognition of that trend and the support led to an increase in repeat buyers of Fresh Express salads, an indicator of loyalty.

The quick pivots during yet another time of volatility worked: Several Fresh Express retail partners outpaced the rest of the market to grow their share by as much as millions of dollars, according to the company. That’s notable, since results cycled growth numbers from the growth-heavy pandemic.

Even as it focused on delivering value to inflation-wary shoppers, Fresh Express has looked ahead and kept R&D efforts rolling. The company recently launched three new chopped kit flavors and one new salad blend, adding variety and shelf interest to the category. The category management team supported planogram builds to include these new items while eliminating slower-moving and high-shrink products.

Likewise, the company has continued to invest in national promotional campaigns throughout the year, using Google PPC and display ads to drive awareness sales. Social media is a priority for Fresh Express, which has a following of 360,000 users. For the first nine months of 2022, the company’s digital ads on social media delivered 1.8 million post engagements and a 2.1 million reach, while its YouTube videos have racked up more than 810,000 views.

A campaign during Salad Month in May was particularly effective. The omnichannel program included social media, digital coupons, influencer and recipe videos, digital ads, an e-newsletter, and a recipe book.

The Hershey Co.

With 125 years of experience behind it, The Hershey Co. doesn’t wait until opportunity knocks. The venerable CPG heard that one important purchase trend was coming and acted swiftly to capitalize on the move.

Hershey puts it this way: “As consumer needs change and shopper behavior evolves, it’s our job to meet them where they are.”

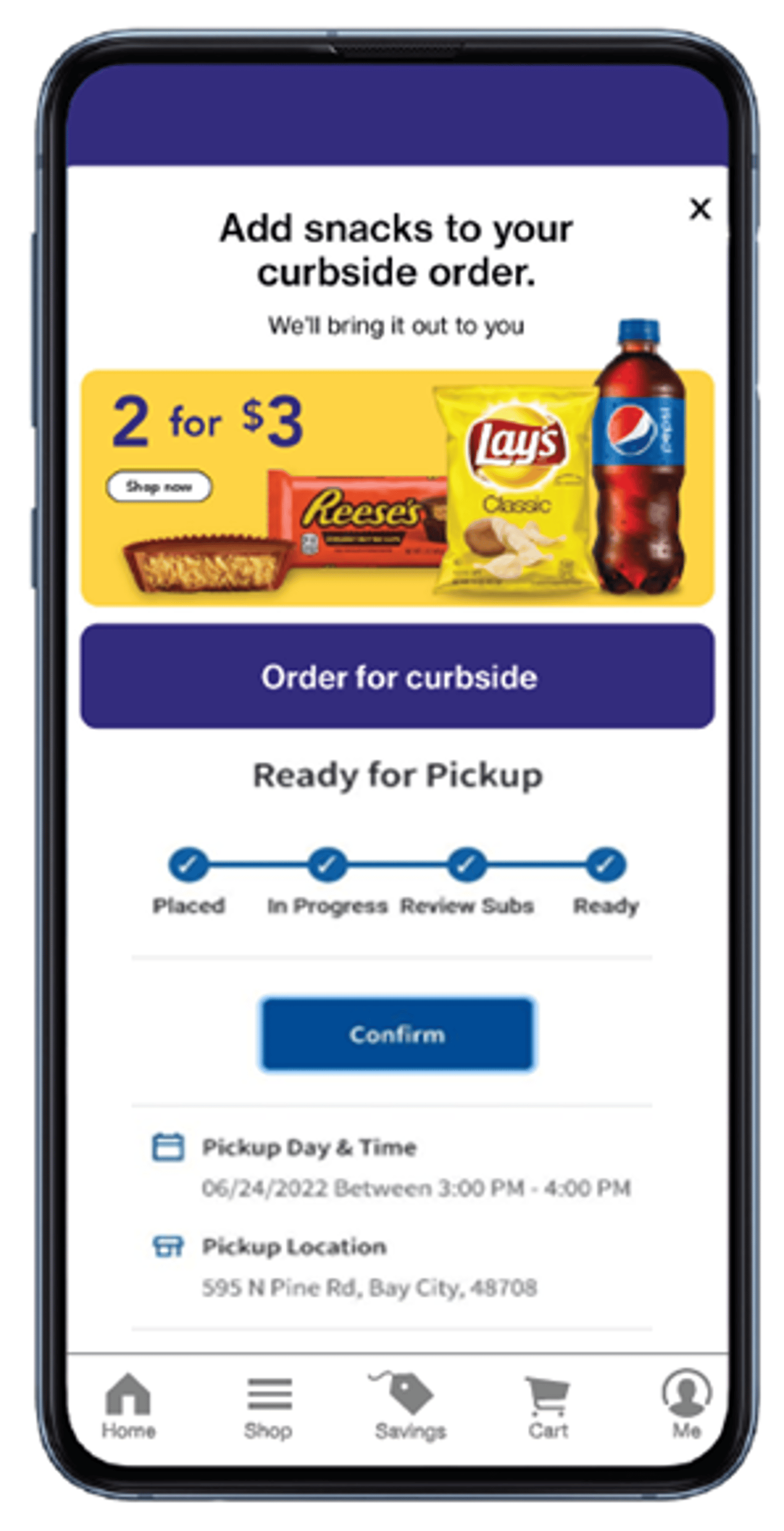

In an era of BOPIS and curbside pickup, Hershey has met many shoppers when they’re in the physical-store space. This opportunity is the “second basket,” occurring when shoppers pick up their click-and-collect groceries and then buy more items in-store on the same day.

There are many reasons that consumers take this additional trip, like going back for forgotten items, wanting to look at certain items in person, swapping out substitutions or purchasing items that aren’t available online. Hershey cites data showing that 10%-20% of click-and-collect trips include a second basket with a $38 average size. The current value of measured second-basket retailers is $3.4 billion across all categories, the company notes.

Given that candies and snacks have long been associated with impulse buys, the opportunity to attract consumers on their way to a second basket is strong. Candy is actually the most impulsive of the categories that land in the second basket, along with snacks, dairy and produce. According to Hershey, there’s an incremental opportunity of $102 million for the candy, mint and gum categories in this type of purchase.

To encourage unplanned purchases and help retailers capture a sizeable second basket, Hershey’s category management and shopper insights teams are targeting shoppers through both in-store and curbside transactions. If timing is everything in promotions, it’s especially crucial here, as Hershey has determined that the most effective points of messaging happen during the “Order is ready” and “On my way” phases of the digital journey. Among other tactics, Hershey offers craving and snack solutions at curbside points, and coupons or reminders of micro-occasions and seasons to drive shoppers back in-store.

In addition to nabbing extra sales in the second basket, Hershey is also finding new opportunities for category success through its Mobile Customer Insights Center, an expandable 53-foot tractor-trailer that looks like a rolling Hershey’s bar and delivers insights, innovation and strategy for the company’s grocery retail partners. Inside the vehicle, grocers and Hershey’s team members meet in a collaborative environment to drive strategies across different facets of the business, from transaction zones to merchandising solutions to alternative fulfillment, among other topics. Hershey notes that at the time of its Category Captains submission, the Insights Center had hosted more than 155 grocery partner attendees at 50-plus meetings around the country in 2022.

Hormel Foods Corp.

While a continually disruptive environment and evolving consumer preferences have driven changes in categories, effective category management is also changing. Hormel Foods Corp. recently redesigned its approach to strategic business planning, engaging its sales team to work cross-functionally with retailers to assess the business, identify new opportunities, and work together to co-create solutions that ultimately benefit shoppers, retailers and Hormel.

The company’s infrastructure has been redesigned to best follow this model. Hormel is in the process of merging five independently run business units into one $8 billion retail sales unit. That unit will be supported by a new center of excellence, Brand Fuel.

Brand Fuel will pinpoint emerging insights to develop products and boost shopper engagement with optimized assortment, shelving and pricing strategies. The Brand Fuel group will also include Hormel’s digital experience team.

As part of this change, the company’s marketing team has moved from a brand-focused team to one structured on need states and solutions. On a more macro level, Hormel had transitioned into three operating segments — retail, foodservice and international — as of Oct. 31 of this year.

It’s no small task to take on so many changes at once, but Hormel has made big strides by zeroing in on shopper insights that drive decisions within categories, and then sharing those insights with retailer partners in the spirit of collaboration. One example is its relationship with an independent Midwest grocery chain; through a cross-functional, cross-category program, Hormel and the retailer teamed up to turn around a typical lull period to grow sales by 29% on a year-over-year basis and net $1.3 million in additional retail sales.

Hormel’s re-envisioned partner approach works across many business areas, including supply chain, category vision and multibrand promotions. Another example is a campaign called The Bowl Bowl, in which many store departments — and categories — came together on an insight-based shopper solution for game day.

Sustainability, increasingly important across categories, is another area in which Hormel and its retail partners align. For instance, the new, more sustainable bottle for Planters peanuts, which uses 8% less plastic and saves 220 tons of plastic annually, has done well for many retailers since its launch in 2022. Hormel supported the refreshed packaging rollout in the nuts category with in-store displays, online advertising and social media.

New product development also reflects the company’s insights-based, shopper-centric and collaborative approach to category growth. In the dynamic plant-based space, Hormel’s recently introduced products include a line of Happy Little Plants meatballs, while its Applegate Naturals Do Good Dogs are made with 100% natural grass-fed beef raised with practices that regenerate the land.

Idaho Potato Commission

The Idaho Potato Commission (IPC) continues to raise its data game using industry-leading insights to drive category growth for its partners. Uniquely, the commission deploys category experts throughout the country to help retailers maximize their sales in the fresh potato category. These industry veterans canvass the country, meeting with category managers to help them stay ahead of evolving shopping patterns.

Within the potato category, one of the most interesting segments over the past five years has been 24-ounce baby or creamer potatoes, which have captured the attention of consumers, causing a wave of new items to enter the segment. As a result, some retailers have run out of space to put them and have really struggled with optimizing category space allocation. The IPC was able to step in, however, with analytics to help advise retailers on how to best merchandise and price the segment to maximize dollars.

One retailer this year experimented with a newly designed set in 2021. The focus for the category was the 24-ounce potato segment in every color and variety imaginable. The retailer ran with the new category layout for six months and relied on the IPC’s capabilities to help it analyze the results, which were were disappointing: The category lost 20% in dollars, contributing to a precipitous loss of market share. Leveraging the IPC’s insights, however, the retailer was able to reverse course and implement mandatory 5-pound bagged russet end caps, which proved much more successful.

In addition to individualized category reviews, the IPC released quarterly deep dives in January 2022. Each deep dive looks at the United States on a regional basis to evaluate the changes occurring within the category. The reviews focus on driving attention to Idaho crop supply updates, potato variety analyses and regional reports for all nine Nielsen reported regions. According to the IPC, these reports have led to multiple customer meetings with its promotion directors and have contributed to 127 in-depth category reviews across the country.

The IPC is helping retailers understand the importance of using russets to win with shoppers. One of the ways it did so was through the creation of an online tool enabling retailers to edit and add price points and recipes to build their own personalized ads. The commission also worked to increase understanding of what makes Idaho potatoes special via product quality, traceability, certified inspections and brand recognition.

Kellogg Co.

A post-pandemic return to mobility and an increasing desire for convenience have led to an uptick in snacking throughout the day, with savory snacks, including pantry crackers, leading the charge. With the knowledge that consumers are averaging more than five snacks per day, that pantry crackers are a growing segment, and that 50% of all food occasions are snacks, Kellogg Co. set out to better understand current cracker shopper and consumer behaviors to find opportunities for innovation.

Kellogg used its proprietary Landmark occasion study to learn more about the loyalty and dollars of younger households and families, with consumer and shopper research informing the fact that afternoon snacking is the No. 1 occasion for crackers. In an effort to take advantage of this key occasion, reinterest lapsed cohorts and further build baskets, the manufacturer introduced Puff’d — a munchable, grazable, airy snack that builds on a strong equity connection with Cheez-Its.

Thus far, the introduction of Puff’d has not only created a win for Kellogg, but has also helped grow incremental sales for the overall cracker category. Some 44% of cracker innovation dollar sales have been driven by Puff’d this year, making the brand the No. 1 innovation introduction in the segment. A total of 71% of Puff’d dollars were incremental to the cracker category, with 67% from category expansion and 4% from new buyers in the aisle. Puff’d is also registering a shorter purchase cycle and seeing a higher household penetration rate compared with total cracker penetration rates in households with children.

Mission Produce

As a global leader in the avocado business since 1983, Mission Produce sources, produces and distributes fresh Hass avocados to retail, wholesale and foodservice customers in more than 25 countries. The company added mangoes to the mix in 2021 and, with an eye toward further innovation, has developed several value-added services to help its customers experience the best returns in their avocado categories.

Through the use of its proprietary Avocado Intel market intelligence tool, Mission can gather data-driven insights to support category management. The tool allows the company to highlight industry trends, perform peer comparisons, analyze store performance, and provide timely category and shopper data, all of which enable it to help customers meet anticipated demand for its products, realize higher profits, attract more shoppers and reduce shrink. Avocado Intel can also inform customers of how the market is responding to Mission’s products and uncover new growth and sales opportunities in real time.

This year, the tool was used to substantially improve organic avocado sales for one of Mission’s largest retailer partners. The company found that 90% of this retailer’s organic avocado shoppers were purchasing organic avocados elsewhere, and that in the Southeast region, this retailer had only a 32% market share of organics, compared with a 51% market share of total avocados. Mission then profiled the shoppers who were purchasing organic avocados elsewhere and found that they earned high incomes, skewed toward families with children and were highly committed to organic products.

Using the information it had gleaned, Mission recommended that the retailer use a bag better designed for the shopper demographic it was missing, and also supported the retailer in the transition. The results were impactful, with the retailer’s avocado category sales increasing by 62% in dollars and 36% in volume year over year. Additionally, dollar and volume shares of the market increased by 8.4 points year over year, and volume share increased from 29.40 to 37.80.

Monterey Mushrooms

As a purveyor of fresh, dried and marinated mushrooms; mushroom powders; and mushroom sauces, Monterey Mushrooms has bet its entire livelihood on the popularity of that particular product. The company, which was established with a single farm in 1971, now has several farms across the United States and offers products for both foodservice and retail.

This past year, company was forced to weather a rough patch when demand for its products decreased. Instead of resting on its laurels, though, Monterey gathered insights from more than 2,000 consumers and revisited its category management approach to develop a plan that focused on growing segments and increasing the size of purchases with frequent users.

At a retail site in one particular region, Monterey chose to place a special emphasis on its growing segments, reviewing everyday retails and aligning promotions with category goals. Over this period of intense scrutiny, sales were up 5.0 points, units were up 4.4 points and pounds were up 3.3 points over the rest of the market. In another region, the same focus was placed on reviewing retails and promotion alignment, and sales went up 2.2 points, units rose 3.9 points and pounds increased 3.5 points over the market.

The company’s new approach, along with a special understanding of its partners’ goals for the category, helped create strong results during a very challenging time.

Pompeian

In a year plagued by inflation, supply issues and shifting consumer preferences, many brands in the olive oil aisle have been forced to pass along a price increase to consumers, causing them to consider switching to less healthy fats and oils. Pompeian, meanwhile, was able to increase sales and build the value perception of olive oil through new promotions, innovations and marketing efforts.

The manufacturer, which offers consumer-friendly packaging with extra-virgin olive oil descriptions such as “Fresh & Fruity” and “Robust,” also spurred category consumption with the launch of seven new e-commerce items. Each olive oil is also labeled with the best uses for its specific variety, including those for roasting, sautéing, stir-frying and mixing into marinades.

The company further found success by reaching out to consumers in unique ways. Its new strategic communications platform helped drive olive oil loyalty via distinct narratives spotlighting product education, usage-heavy recipes, and the benefits of shopping farmer-owned, planet-friendly brands. On social media, Pompeian expanded its target and prioritized video, a bolder tone/aesthetic and relatable recipe content.

These pivots generated a 746% increase in paid Facebook and Instagram engagements between the first and second quarters, as well as a 31% increase in Instagram impressions. Retail-driving influencer programs resulted in more than 42,000 cart additions of the company’s products via Instacart, and an Amazon Live with the same objective drove approximately 500 sales in one hour.

Additionally, Pompeian prioritized stock availability and speed, as well as price reductions tied to on-shelf communication during key selling periods, with one such effort generating a 26% incremental sales lift over Easter. The company also worked with complementary store departments to encourage at-home cooking, and in the Midwest, Pompeian put a display in the produce section where shoppers could receive a free bag of potatoes with the purchase of Pompeian olive oil.

All of this led to double-digit sales increases for Pompeian that offset category volume declines and bolstered category dollar sales compared with last year.

NatureSweet

Produce provider NatureSweet expanded its fair-trade partnership to two strategic divisions within a large national retailer in early 2022. The program provided the retailer a point of differentiation in the market when media outlets brought attention to the unethical treatment of agricultural workers in North America. Fair trade ensures that workers receive fair wages, work in safe conditions, protect the environment and obtain community development funds to improve their lives.

Fair trade has given NatureSweet the opportunity to add value to the entire supply chain, as well as allowing the company to continue to pursue its mission of transforming the lives of agricultural workers in North America by keeping people its top priority. In tandem with what it does for its associates and their families and communities, NatureSweet’s commitment to Fair Trade Certification augments its already long-standing relationship and certification with EFI, also known as the Equitable Food Initiative. This initiative was executed at the national retailer’s fair-trade divisions through on-shelf mini billboards, secondary displays with messaging, and online banner ads that received 328,359 impressions, or more than 20,000 impressions per day, in May 2022.

In the first eight weeks through June 18, the two fair-trade divisions realized a 200-basis-point advantage in dollar percentage growth and a 50-basis-point advantage in trips over the remaining national retailer’s non-fair-trade divisions. These improvements led to the fair-trade divisions realizing a 30-basis-point greater improvement in market share within the snacking tomato segment than the non-fair-trade divisions. The fair-trade divisions sold nearly 273,000 pounds across three items, resulting in a $13,000 premium paid to support fair-trade initiatives transforming communities.

Additionally, fair-trade initiatives are voted on by NatureSweet associates. Each of NatureSweet’s agricultural plants have fair-trade committees to represent associates. Members are elected by peers, and a supervisory board serves as the voice of about 5,000 associates. Initiatives include education, child care, food, health services, housing, infrastructure, training and community services. For example, an education program teaches associates to read and write. In 2021, about 150 associates earned their high school degrees.

Each of NatureSweet’s facilities has a health and safety manager who leads developmental training, addresses issues and takes precautionary measures to prevent any injury. The company provides preventive health care for associates that includes access to a variety of medical services, with mental and emotional health top priorities. This is why NatureSweet created programs like Sweet Life, which gives associates access to psychologists and one-on-one therapy. Additionally, the Sweet Family program is a 16-week course that educates associates on human development, with topics such as parenting and emotional intelligence, to name just a few. Initiatives like these help complement the company’s purpose, which comes back to improving the lives of agricultural workers in North America.

Pharmavite

Although inflation surpassed COVID as the chief concern for U.S. consumers this year, Pharmavite’s new product initiatives were able to help sustain vitamin, mineral and Supplement (VMS) category growth. Post-pandemic, self-care has risen to the top of the category entry points. Consumers are no longer thinking of the category for a specific health concern, but as a ritual to proactively take care of themselves. This has resulted in the VMS category evolving into two distinct needs for purchase conversion: general wellness and specialized needs.

To ensure that the company is serving both types of consumers, Pharmavite’s Nature Made brand expanded earlier this year with the launch of Nature Made Wellblends, a line of 13 scientifically developed supplements to keep the wellness cycle of sleep, stress and immune health in balance. Stress leads to sleep problems, and both issues can compromise the immune system.

To support its curated line of products, the company kicked off a partnership in June with home organization experts and stars of the popular Netflix series “Get Organized with The Home Edit,” Clea Shearer and Joanna Teplin, to inspire people to optimize their wellness routines and keep stress, sleep and immune health in balance. Through the partnership, The Home Edit founders shared their own experiences as well as how Nature Made Wellblends’ targeted solutions helped them proactively support their overall well-being as they navigate running their business, motherhood, busy schedules, travel and life’s stressors. Retail media campaigns ran across traditional TV as well as streaming platforms, and digital and social channels engaged influencer support. Additionally, relevant lifestyle- and health-focused podcasts reached consumers throughout their day in key markets.

Meanwhile, Pharmavite has also committed to advancing its operations. In fact, the company was working to alleviate pandemic-induced supply chain challenges long before COVID ever reached North America. Specifically, in the past year, the company consolidated bottle sizes, added air-freight methods of bulk deliveries and stretched its organizations teams to the max to get product on retail shelves. Pharmavite also revamped its recruitment process to attract top talent as its needs have grown.

To help retailer partners be as successful as possible, Pharmavite’s Aisle of the Future project has identified top-level insights for retailers and brought them to life online and in-store. Pharmavite category managers have introduced new options to help retailer partners fit their strategies against a menu of proprietary opportunities to best match joint business needs. The category management team has a deep toolbox of resources at its fingertips, including an assortment optimization tool for retail line reviews. This model has helped simulate demand transfer of volume when items are removed from or added to the assortment, enabling retailers to seamlessly make category assortment and new-item decisions.

Nestlé Purina

The expectations for a more engaging and frictionless shopping experience have never been higher. Pet care company Nestlé Purina knows that brands and retailers that drive these elevated experiences will stand out above the rest. As a result, the company is dedicated to delivering omnichannel solutions in this space and demonstrating the importance of the pet category with its strategic partners.

Dedicated pet end caps have been a foundational merchandising solution that Purina’s Shopper Innovation & Experience team has recommended to retail partners for years. But as the world becomes more digitally connected and focused on the omnichannel experience, the company has partnered with strategic retailers to drive more pet category traffic, brand conversion and customer loyalty through purposeful digital solutions, all rooted in Purina’s emerging category insights and strategies.

These solutions are brought to life at Purina’s Retail Innovation Center, in St. Louis — an experiential learning lab highlighting omnichannel solutions that inspire new business prospects — and are then used to engage top retailers in a proprietary co-creation process to build out opportunities that deliver mutual value for the retailer, Purina and ultimately, the pet shopper.

Meijer Inc. is one of Purina’s most progressive partners, and during its annual business-planning visit to the Retail Innovation Center the retailer was introduced to an interactive pet end cap powered by Perch technology — a digital in-store solution that seamlessly incorporates a digital screen to automatically sense which products shoppers touch, and then responds with videos and information about the product.

Using the Retail Innovation Center’s co-creation process, the team inspired a Meijer-specific solution with the SVP of merchandising, marketing team and buyers. This drove immediate buy-in on an idea to launch an interactive end cap at scale, anchored in a category-first approach. For example, instead of leading with a Purina One brand story, the project started with a narrative on the power of “outcome-based nutrition,” and then supported it with why the Purina One portfolio could deliver on that need. These category “stories” change throughout the year and feature anything from litter education to the benefit of variety in wet cat food, and even cause-based programming.

Pet parents have certainly taken notice of these interactive end caps powered by “lift-and-learn” technology during their shopping trips to Meijer stores. This is evident in the impressive results for both the Midwest grocer and Purina since the launch of the engagement tool. For instance, Perch-enabled stores are consistently outperforming non-Perch-enabled stores by double digits, and Purina is seeing brand growth in nearly all strategic segments. Even more exciting are the analytics that the team has captured regarding engagement rate, which continues to climb, showing that this solution is establishing a new shopper behavior while driving conversion. That’s a win-win for both the retailer and the CPG company.