The Predictable Rise of Instacart

Predicting the future is inherently difficult, even if you work in a futuristic industry like online grocery. But only nine months ago, Instacart President Nilam Ganenthiran did exactly that.

In a not-much-noticed press release published by the company on Jan. 14 — before COVID-19 would change the world — Ganenthiran proclaimed that 2020 would be “the year for online grocery pickup.”

Eight weeks later, the U.S. federal government declared a national emergency over the pandemic, and everyone was typing “Can you get coronavirus at the grocery store?” into Google. Suddenly, tens of millions of Americans wanted to buy groceries online and were waking up at 3 a.m. to find a grocery pickup (or delivery) slot on Instacart.com. In the eyes of consumers and grocers, the company’s grocery e-commerce service had morphed from niche to necessity. And with so much demand, Instacart was going to face operational challenges more severe than even Ganenthiran could have ever prophesized.

DISCOVER MORE ON INSTACART

- Algorithms for Avocados: Instacart's technology serves to delight the customer.

- Curbing Friction With Pickup: Customized solutions help grocers get it right.

“It’s crazy to think about this, but in a two-to-four week period, we experienced the adoption of grocery e-commerce that we were expecting to see in a two-to-four year period,” Ganenthiran said. “We saw a 500% jump in order volume. Almost overnight, we saw basket sizes expand 35% and Instacart become a lifeline for people across North America looking to get their groceries and goods delivered. We saw things that normally are always in stock — toilet paper, bottled water — just disappear from store shelves. And we had over 500 retailers, across nearly 40,000 retail store locations, more than half of North American grocery e-commerce basically, looking at us and saying, ‘Hey, you got to be there and show up for our customers.’”

Fast-forward eight months. Today, Ganenthiran and the rest of the Instacart executive team have moved a bit beyond worrying about toilet paper stocks. They’re now laser-focused on leveraging the growth opportunity before them, and on building a future vision to help the grocery industry thrive during the next pandemic and beyond.

Four-Sided Marketplace

Founded in San Francisco in 2012 by former Amazon engineer Apoorva Mehta and his friends, Instacart’s mission was then, and remains now, to help brick-and-mortar grocers be successful online. Since then, the company has been measuring that success by scale, expanding rapidly into new geographical markets and launching new features designed to make grocery e-commerce irresistible to consumers.

Then in March, irresistible turned into essential.

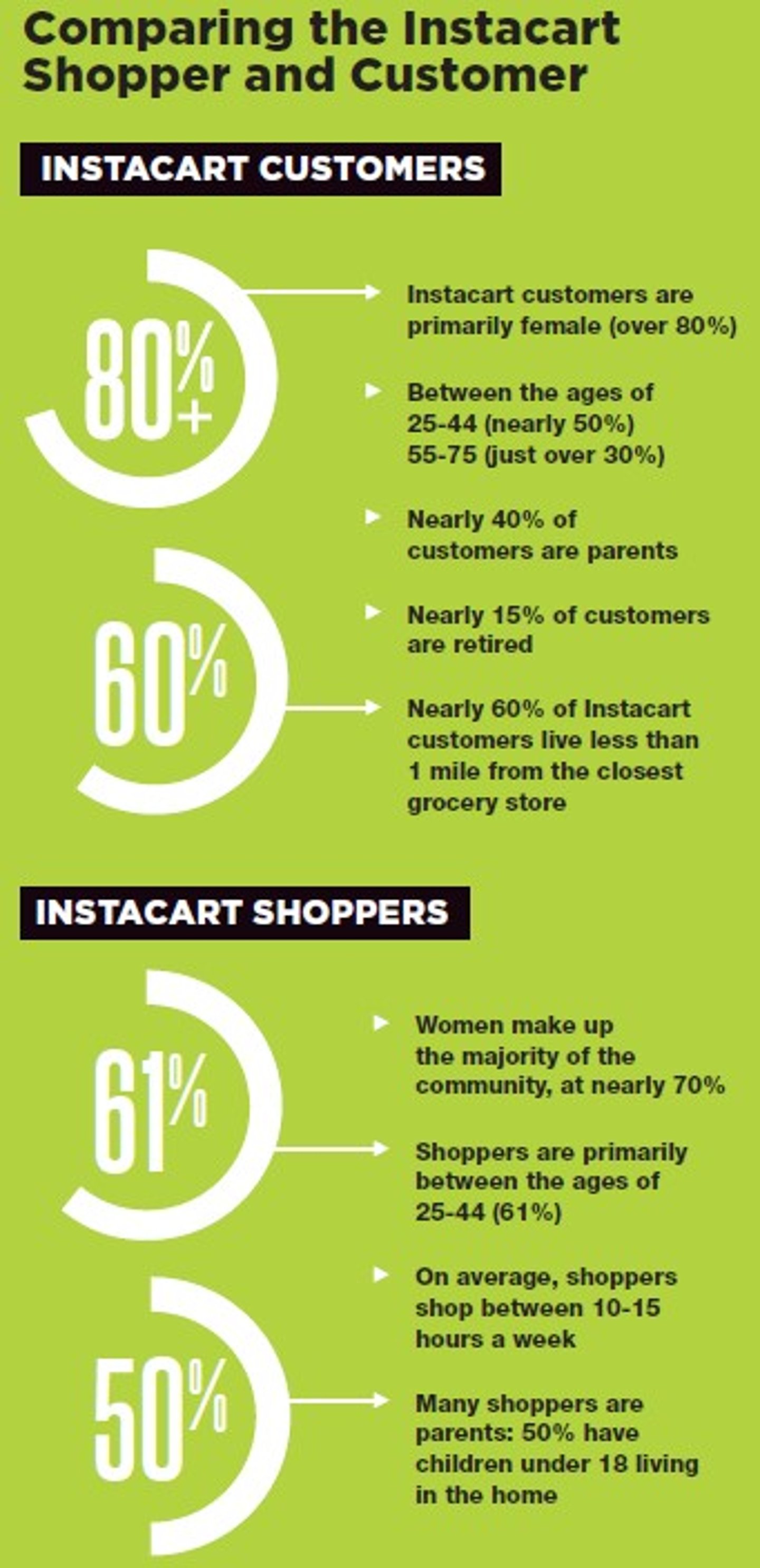

Since the COVID surge, nearly 750,000 “shoppers,” more than half of which were hired since the coronavirus outbreak, have been shopping on the Instacart platform. These are the mostly independent contractor workers who pick orders, stage them for pickup or deliver them to customer homes. On any given week, the company, which has about 2,000 full-time workers, has 100,000 shoppers picking orders on the platform.

“We brought on board those new shoppers while increasing our shopper satisfaction as measured by our Net Promoter Score,” says Ganenthiran, who believes that the days of a retailer not offering e-commerce pickup and delivery are definitely over. “Today, our shoppers are happier working on our platform than they’ve ever been in the past. The credit goes to our teams, who have been coming up with new programming to support shoppers and continuously being the voice of our shoppers during this time, while also adding 8,000 new store locations, 150-plus new retailers and expanding pickup to more than 1,500 new stores.”

Indeed, it’s not just the size of its shopper network that has exploded since the pandemic. Every part of the Instacart business has accelerated, from the number of its retailer customers to the size of its Instacart Care team to the breadth of its consumer packaged goods (CPG) partners (now more than 1,000 brands). The company’s shoppers and retailers make up two sides of what Instacart calls a “four-sided marketplace” business model that also includes consumers and CPGs. Instacart makes money from delivery fees, as well as from partnerships with CPG and retailer partners. It remains to be seen whether the model is profitable or sustainable beyond all of this pandemic demand for grocery e-commerce (Instacart doesn’t publicize specific sales figures); Ganenthiran says that it’s a unique model that’s difficult to manage but perfectly positioned to leverage what he sees as an unstoppable digital renaissance in grocery.

Bringing things back in balance means “using technology and scale to be able to lower costs while also making sure our retailers’ P&Ls are healthy,” he explains. It also means building great apps and websites on behalf of the company’s retail partners, turning technology into something they can use to create custom experiences and build online stores to connect with their shoppers. Instacart has a robust Enterprise business building websites for grocers such as Wegmans Food Markets and Heinen’s.

“The breadth of ways that we’re partnering with the grocery industry to do that has evolved where now Instacart Enterprise plays a more important part, where we’re building websites and apps and today power the full e-commerce experience for more than 175 grocers,” Ganenthiran notes. “It’s not just about delivery anymore. We’re constantly trying to find new ways that we can add value as a chief ally to our partners and believe we can by building the technical e-commerce infrastructure for retailers big and small.”

Speaking of value, in June Instacart raised $225 million in a new round of financing, making it one of the most valuable private companies in the United States. (Ganenthiran says that Instacart will eventually be a public company — one day.) The round increased Instacart’s valuation to $13.7 billion, up from $8 billion when it last raised money, in 2018. The new cash infusion comes at a pivotal time for the company. In October, another $200 million funding round valued the company at a valuation of $17.7 billion.

According to San Mateo, California-based research firm Second Measure, which tracks credit-card spending, Instacart’s share of grocery pickup and delivery sales jumped to 55% in the third week of May, up from about 30% in February, pushing past Walmart. Perhaps that’s one reason Instacart announced in August that it has partnered with Bentonville, Arkansas-based Walmart to offer same-day delivery in four test markets in California and Oklahoma. In September, Instacart ramped up expansion efforts even further by teaming up with Dallas-based 7-Eleven, its first national convenience store retail partner, to expand same-day grocery delivery.

In addition to groceries and everyday goods, Instacart has expanded its offering over the past year to include alcohol and prescription delivery (Costco), beauty (Sephora) and now even general merchandise (Big Lots). The company plans to expand its Instacart Meals program, first launched with Lakeland, Florida-based Publix earlier this year, to more retailers in the coming months.

Instacart is now accessible to more than 85% of households in the United States and more than 70% of households in Canada. The company has accelerated its launch cadence with retailers since the start of the year, and now partners with more than 400 national, regional and local retailers across North America to deliver from more than 30,000 stores across 5,500-plus cities in the United States — encompassing all 50 states — and Canada.

All of this growth is driving the company to upgrade its value proposition to all four sides of its marketplace.

“We are benefiting from a tremendous tailwind, and we have been very fortunate to be able to partner with the best retailers out there,” Ganenthiran asserts. “We take the position that they have given us, as their partner, the e-commerce partner, to lift up brick and mortar, very seriously. And we can’t rest on our laurels. We have to do everything possible to lift our retailers.”

The Future Is Already Here

As part of its strategy to help grocers own the digital food future, Instacart is making some major changes to the way it operates. The company is deploying its resources in a number of new ways as it looks to lift up grocery e-commerce for its retailer partners. Among them is continuing to grow and support its growing shopper community with new workforce initiatives, investing in helping retailers achieve greater operational efficiencies with e-commerce, improving customer service, and further scaling its technical teams to help meet the increased customer demand for grocery delivery and pickup.

Supporting its hundreds of thousands of shoppers has been job one, although Instacart’s workforce is facing uncertainty in California over worker classification efforts. The company, along with Uber, Lyft and DoorDash, is backing a November ballot measure, Prop 22. The measure, if it passes, would exempt rideshare and delivery workers from the California labor law known as AB5, which went into effect this year and makes it harder for companies to classify workers as independent contractors.

“If Prop 22 doesn’t pass, things will probably have to change. Our accessibility may be impacted, we may no longer be able to provide earnings opportunities to all of our shoppers in California, and the cost to customers may increase. We’re committed to finding an approach that preserves what’s best about our model for customers and retailers, while finding solutions that further support shoppers, such as benefits like earnings guarantees and health care.”

In the meantime, Instacart has overhauled every part of how it hires, trains and onboards shoppers, from background checks, to converting physical ID cards to digital cards, to recruiting efforts via social media and referrals. The company has even teamed up with big-name employers such as Hertz and Hilton to hire some of their furloughed workers.

Ganenthiran says that the company took its workforce protocols “all the way back down to the studs,” and has prioritized safety and training programs that help shoppers be ready to pick the perfect avocado. Shoppers now have an exclusive “super-app” to help them navigate grocery stores, find where the deli is, navigate to a customer’s home, and more. The company has also been working closely with retailers to optimize e-commerce fulfillment operations in-store.

“We’re deeply involved with grocers’ store-planning and real estate teams on the most efficient ways to set up the store to fulfill e-commerce orders,” Ganenthiran observes. “Where’s the best place to put a staging area? How do I think about pickup and the flow there? What do I ask the landlord about curbside pickup? Do I need dedicated parking spots for customers to come and pick up their orders? Do I need dedicated parking spots for the Instacart personal shoppers?”

Most Popular Search Terms on Instacart in 2020

- Cleaning products

- Toilet paper

- Bird food

- Melatonin

- Yeast

- All-purpose flour

- Pumpkin spice

- Hair dye

- Tanning lotion

- Pickling

- Mason jars

- Protein supplements

- Açai drinks

The company gives retailers access to a lot of data science modeling showing how to shave seconds and minutes off the picking process to save costs. But, Ganenthiran says, there’s one thing he wants grocers to realize:

“The most important thing that grocers need to understand about Instacart is we have not, and will not, compete with our grocers. If you’re a grocer, we want you to consider us as a true partner and extension of your team and think about us through the lens of, ‘Okay, how can I work in partnership so that I can use Instacart’s strengths to make my strengths even better?’”

Delighting customers is something that Ganenthiran also thinks the industry needs to focus on, and that goal was a guiding principle when the company expanded its customer service team, early in the pandemic, from 1,200 to 18,000 agents. Grocery e-commerce customers, whether on Instacart or other platforms, often complain about late deliveries, missing items, inappropriate item substitutions or out-of-stocks.

“We had a lot of first-time consumers trying grocery e-commerce,” he says. “And, you know, every minute of every day that we’re disappointing customers, I feel it personally, because I understand that’s a single human being who is disappointed with their strawberries. So we work night and day to try to rectify the situation and are constantly focused on how we can improve our overall quality and deliver customers an exceptional experience. And that included a few things.”

The company made the decision to overstaff its customer service department, and became comfortable with not trying to forecast staffing down to the second. It also started not just retraining agents, but “overtraining” them to make the customer happy, no matter what. The third thing that the company did was re-evaluate how customers could contact Instacart Care.

“We realized the most efficient way and best way for customers to get order issues resolved was through chat,” Ganenthiran says. Instacart also launched a special toll-free number for older customers to use for placing orders.

“Today, our customer SLAs [service-level agreements] are better than they were pre-pandemic,” Ganenthiran notes. “Our CSAT [customer satisfaction] score for folks who are contacting us is significantly higher. Our costs are back in line, and we’re now able to even extend new ways that our customer service team can help.”

Of course, the No. 1 customer service problem for Instacart during the pandemic has been out-of-stocks. According to Ganenthiran, Instacart engineers have spent a lot of time over the past few months building different machine-learning models and using artificial intelligence to better assess whether a certain product has run out.

“What is the next best product?” he ponders. “And then, based off a customer’s previous purchasing habits, giving our shoppers a better sense of what will be an acceptable replacement. There’s a lot of invisible technology that we’ve built to actually make the experience for the shopper as simple and as clean as possible so that they are able to deliver the best experience for the customer as well.”

Three things are certain in this period of uncertainty: grocery e-commerce is here to stay, the American consumer is fickle, and Instacart plans to help grocers win more customers in a permanently transformed grocery retail landscape.

All three will matter, and no matter how many competitors spring up (Uber, DoorDash, Shipt and Amazon, to name just a few), Instacart’s value proposition will remain helping grocers win in e-commerce.

“There’s two big differences between Instacart and all of its competitors,” Ganenthiran points out. “The first is Instacart doesn’t compete with our retailers. The second difference is our commitment not just to a marketplace, a multi-retailer marketplace, but the retailers’ own sites, via the Instacart Enterprise offering. We believe Instacart will be successful if brick-and-mortar grocery is successful. Competition is inevitable, and competition has always existed. So we just have to keep doing better.”

Doing better and being nimble is what Instacart has proved that it’s capable of. But the real challenge going forward will be proving that it can become a profitable, sustainable business.