Online Grocery Sees First Dip Since COVID-19

Grocery e-commerce orders for pickup and delivery have been growing at a rapid rate since mid-March, spurred by the COVID-19 pandemic and customer attitudes toward in-store shopping. The latest Brick Meets Click/Mercatus Grocery Shopping Survey, however, shows that June may have been the online grocery peak.

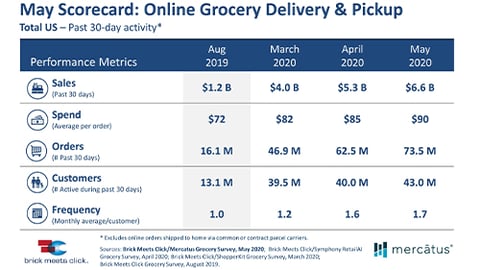

August 2020 e-commerce grocery sales totaled $5.7 billion, approximately a 20% drop compared to June. The numbers are still much greater than the year-ago period when sales were $1.2 billion though.

According to the survey results, approximately 37.5 million, or 29% of all U.S. households, are considered monthly active users of these online grocery services in August 2020 compared to 16.1 million in August 2019.

The ongoing research has documented a steady decline in the percentage of households that express a high level of concern about contracting the virus, dropping from a high of 47% in April to 38% in August.

“There is a common belief that the rapid and dramatic surge in sales caused by COVID-19, starting in mid-March, would recede at some point as stay-at-home orders and in-store shopping restrictions like occupancy limits, shortened hours and one-way aisles were relaxed,” said David Bishop, partner, Brick Meets Click. “While the August results reflect a retrenchment of sorts, the market appears positioned to begin a new growth cycle with a large base of committed shoppers.”

On a year-over-year basis, monthly active online grocery shoppers are spending more per order and placing more orders per month according to the research. Spending per order rose to a record $95 in August 2020 – 32% higher than a year ago – and active shoppers placed 1.6 orders per month compared to 1.0 orders in August 2019. In June, active shoppers placed 1.9 orders.

Also, during August, 75% of customers indicated that they are extremely or very likely to use their most recent online grocery service provider again within the next 30 days. This level of repeat intent is a significant improvement from the previous four months (March was 43%, April was 50%, May was 56% and June was 57%). August 2020's repeat intent also slightly surpasses the rate reported during August 2019 (74%), which highlights how improved retail conditions are leading to stronger shopping experiences.

“The rise in repeat purchases and spending means grocers are successfully acquiring new online shoppers, and equally as important, converting existing digitally engaged customers,” said Sylvain Perrier, president and CEO, Mercatus. “Even with diminished concern about COVID-19, grocery shoppers are realizing the benefits of a streamlined and frictionless online shopping experience. Going forward, it’s critical that grocery executives focus their teams on rewarding online shoppers by delivering a differentiated eCommerce experience that caters to consumers’ high expectations.”

The latest Brick Meets Click/Mercatus Grocery Shopping Survey was fielded Aug. 24-26 with 1,817 adults, 18 years and older, who participated in the household’s grocery shopping.