E-Grocery's 5-Year Plan

E-commerce, hailed as the Next Big Thing, is still a thing and still big, but perhaps not in the same capital-letter, bold-print way. On the heels of its new five-year forecast on e-grocery sales, Brick Meets Click partner David Bishop told Progressive Grocer that what was once a fast-moving, novel space is showing longer-term definition.

“E-grocery is growing three times faster than in-store, but it used to grow a lot faster, even before COVID. It was 15% before the pandemic, two years ago it was 6% to 7% and now we are seeing about 4%,” Bishop said in a recent interview. “The deceleration shows that it’s not really an emerging segment anymore. We are in a mature market now, and we need to find the next growth curve.”

[RELATED: Food Lion Expands Home Delivery Across 7 States]

Indeed, while expansion in e-grocery is expected to continue, the more muted pace means that grocers and partners need to hone in on innovation to keep or gain their share of the tightly-held food dollar. “You are seeing some experimentation. Walmart, for example, is picking at the edges with early morning and late night delivery,” Bishop remarked. “We’ve seeing another evolution with the rise of subscription services, and that’s really to retain heavier shoppers.”

As competition grows in a modest expansion environment, many grocers will work to drive demand through first-party services to better control their operating costs and customer experiences, according to Bishop. “It’s about being able to make choices. If you are third party versus first party, you are somewhat captive to the provider in terms of what you can do and can’t do. We see a greater orientation now to first party, where grocers try to shape demand to flow to their business,” he explained.

Still, third party does and will be a core part of e-grocery through 2028, the Brick Meets Click forecast emphasized. “Even Walmart uses third party, so we are not saying, ‘Don’t use third party’,’” Bishop declared, adding that advances like retail media will help third-party services rein in fees that become barriers.

Pickup, which has been a hotbed of activity in recent years, remains another area of opportunity. “You drive customers to the store, which removes the last-mile conundrum, and you can build an opportunity for unplanned trips into the store,” Bishop pointed out.

Traditional grocers can pursue a parallel track to growth in this climate by focusing on their strengths at the physical store. “As a shopper, you may value a store’s service department or the quality of their produce. A sense of community is part of the shopping experience,” Bishop said.

The five-year e-grocery forecast from Brick Meets Click, sponsored by Mercatus, included other notable projections:

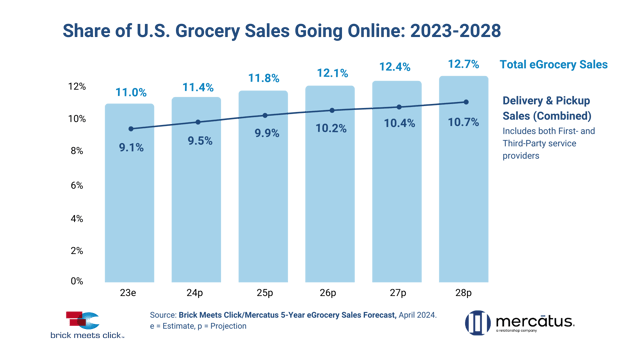

- Total e-grocery sales, including delivery pickup and ship-to-home, are estimated to hit almost $120 billion annually by the end of 2028, and account for 12.7% of total grocery sales in the United States.

- Pickup sales are expected to grow faster (5.4%) than delivery (4.4%) or ship-to-home (2.8%) through 2028.

- Pickup will remain the dominant method, accounting for nearly 47% of all online grocery sales at the end of five years.

- Order frequency will be an important growth driver during this period.

Mark Fairhurst, global chief growth officer at Mercatus, noted that the report underlines the importance of insights in finding new pockets of profitability. “It’s clear that creating stronger connections with existing customers is essential to driving higher spending and order activity,” he observed. “Expanding personalization efforts to include targeted offers or tailored recommendations, will play a vital role in increasing repeat purchase behavior and e-grocery sales.”

The top retailers and solution providers in grocery will be talking about innovations like personalization and much more at Progressive Grocer's annual GroceryTech event in Dallas on June 5-7. Click here for more information and to register now.