3 Takeaways From ‘The Power of Meat 2024’ Study

Meat has an enviable position as a category, with 98.2% household penetration. But, as the new "The Power of Meat 2024" report shows, there are opportunities for more growth as well as areas where growth may change or even fall off. In other words, there’s no resting on traditional center-of-the plate and perimeter-of-the-store laurels.

To be sure, the latest "The Power of Meat" report conducted for FMI - The Food Industry Association and the Meat Institute (formerly the North American Meat Institute) by 210 Analytics is chock full of data related to animal proteins. According to the study, meat remains the largest revenue generator in fresh departments, even as dollar sales came in flat last year and volume was down a bit.

[RELATED: FMI, Meat Institute Honor Young Pros in Protein]

A deep dive into the report reveals some key takeaways for retailers looking to maintain, expand or optimize meat sales in an era when consumers are driven by a host of factors.

1. The World of “And”

Those multiple motivations, in fact, were a highlight of the Power of Meat session. At the Annual Meat Conference (AMC) in Nashville on March 18, 210 Analytics principal Anne-Marie Roerink stressed the significance of one word: “and.”

The market has always been multifaceted but now, consumers want more out of the meat they buy at supermarkets, even as they are mindful of price. “It is a world of ‘and’,” Roerink told the large crowd at AMC. “No one is on price alone. It’s the world of price and nutrition, price and convenience, price and sustainability, price and health,” she explained.

Those expectations, in turn, can place pressure on those who produce and purvey meat. “All of those things can make our lives challenging, but also offer a lot of opportunities,” she added.

Roerink shared some of those opportunities in "The Power of Meat" report and during her presentation. For example, to provide solutions to shoppers who want affordable, convenient meal solutions, retailers are getting creative by providing mix-and-match offerings of smaller portions, like “Pick 3 for $9.99.” They are also promoting deli prepared meals for households of two or four people and packaging items that are ready for the crock pot or air fryer. Meanwhile, for shoppers seeking value and health, grocers promote family-friendly meats that are rich in nutrients.

[RELAED: What, Exactly, Is Value to Today’s Shoppers?]

For shoppers who want variety and value, grocers are likewise getting inventive. Roerink shared a photo of fresh bratwurst studded with candy corn that turned out to be a hit for one grocer. (“As horrible as it looks, it actually tastes great – a little bit like a breakfast sausage, with that candy corn melted,” she noted.)

Rick Stein, VP of fresh foods at FMI, said that the notion of “and” extends to many aspects of meat retailing, including the ways meat is merchandised and promoted to shoppers. “With the ‘and’ piece, we have to talk about meat and the other things that resonate with the consumer. I weighed in heavily on the whole idea of flavor. That’s a part of the meat department that we take for granted and don’t play up enough in our communications. We should be exploiting flavor,” he told Progressive Grocer in a sit-down interview.

2. Mind the Generation Gap

Tied into the idea of being many things at once to the consumer, another lightbulb moment at this year’s Power of Meat presentation was a graphic detailing the Thanksgiving protein preferences of different generations. A strong majority of 81% of Baby Boomers choose turkey for Thanksgiving, compared to 73% of Gen Z consumers. Those younger consumers born around or after 1997 include a lot of other proteins in Thanksgiving celebrations, including chicken (42%), beef (25%) seafood (16%) and even burgers and hot dogs (21%). Only 1% of Boomers are having burgers and hot dogs on the Thanksgiving occasion.

Other data from the Power of Meat shows that Gen Z is trending away from traditional protein sources. The group over-indexes for chicken and under-indexes for beef and pork, for example. Their perceptions of protein are also different, as Gen Z lists the top five protein associations as “meat” (24%), “healthy” (11%), “protein drink” (9%), “workout” (6%) and “muscle” (6%). That contrasts with Boomers, who say they associate protein with “meat” (43%), “chicken” (7%), “healthy” (6%), “steak” (5%) and “essential” (4%).

“Everywhere we look, there is a big generational gap in meat purchases. We’ve catered to the Boomer generation for 30 years, if you think about it. We have to figure out how to ride that fence for a while, catering to Boomers while getting ready for Gen X, Gen Z and Millennials. That’s going to be one of the challenges over the next couple of years,” Roerink asserted.

[Never miss a story – sign up for Progressive Grocer's FREE Daily newsletter]

Here, too, Stein advised retailers to lean into the strength of meat, with protein and other nutrients absorbed more readily than other protein sources that are popular among younger consumers, like some bars and drinks.

“We have Krystal Register at FMI who leads our health and well-being initiative and she says that retail dietitians will tell her that they can walk any customer in the meat department and talk about the health benefits of any one of those proteins,” he said. “I think that’s going to be more important for the younger generations, because they may have the stigma that pork or red meat isn’t as healthy as chicken, and so we need to help them understand that.”

3. Make Meat a Destination

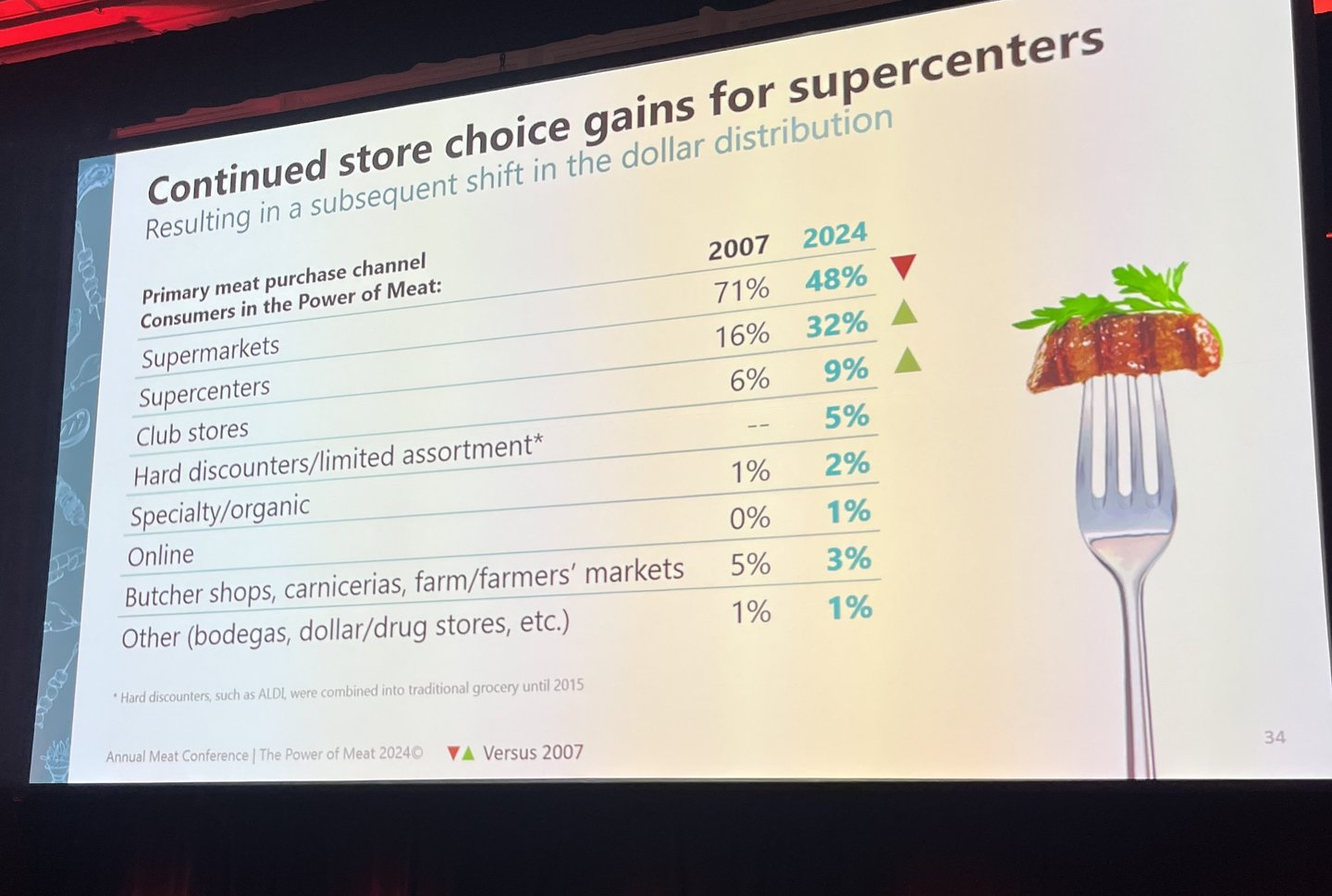

This year’s study revealed major shifts in where consumers are buying meat. In 2007, supermarkets were the primary meat purchase channel, with 71% of purchases, compared to 16% for supercenters. Today, traditional grocery stores are at 48% and supercenters are at 32%. Club stores picked up 3% and the advent of online shopping siphoned away another 1%.

Roerink said these changing dynamics should spur grocers to double down on their selling tactics. “But more than anything, as much as we can try to optimize our locations and be a destination, it all comes down to optimizing the spending while we have people in the store,” she said, adding that it is not about a “race to the bottom” for prices but a thoughtful way of providing the different aspects of value – the all-important “ands” – that consumers are seeking.

More information about the study is available online.