2019 Outlook: The Year Grocers Bring Endless Aisles In-Store

(Editors' note: This is part four of a five-part series)

Retailers are feverish about creating their point of differentiation and an improved in-store experience. But for shoppers, delightful design and warm hospitality are diminished when the products they seek aren’t on the shelves, either due to dreaded out-of-stocks or because slow-moving items were removed.

Endless aisles online are becoming the norm, with shoppers blissfully unaware that items they obtain through a retailer’s website might not be items that retailers typically carry and are delivered by a third-party vendor. Grocery isn’t immune from the new age of 24/7 shopping and the expectation of next-day — or less — delivery, and it’s increasingly viewed as their opportunity to offer one-stop shopping.

Read Our 5 Predictions of How Grocery Technology will Transform in 2019

- Introduction: What to Expect in Grocery Technology in 2019

- Part One: The Year Grocers Bridge the Digital and Physical

- Part Two: The Year Grocers Crack the Code to Ecommerce Profitability

- Part Three: The Year Grocers Make the Shopping Experience Mobile-Centric

- Part Five: The Year Grocers Connect Everyday Activity and Ecommerce

When done well, endless aisles provide valuable data on the habits and preferences of shoppers, which can shape online and in-store assortment. The concept can also act as a catalyst for discovery, introducing shoppers to complementary or specialty products. In store, endless aisles can help the retailer keep shopper dollars and the shopper’s satisfaction.

Endless aisles haven’t been without challenges, however, according to Bill Bishop, chief architect at Brick Meets Click, a Barrington, Ill.-based consultancy. “If not done well, and especially if retailers cede fulfillment to a third party who is not on the same page as the retailer, it can create greater frustration than the original disappointment of not finding the right product in the store.”

“The retailer’s success with endless aisles is with the right fulfillment partners that can deliver on the back end,” says Helen Baptist, chief customer officer of Chicago-based ItemMaster, which works with retailers and their supplier partners to provide consistent quality across search, sort and select.

One challenge that Baptist sees with in-store endless aisles is that the ecommerce team might not have anything to do with the in-store ordering mechanism, such as a kiosk, touchpad or via the store app.

“All content should reside in one place, regardless of source, and it should be consistent with the specifications the retailer has identified as ideal for the customer experience,” she advises.

According to Scott DeGraeve, COO and founder of Denver-based Locai, an ecommerce platform that manages retail and fulfillment partnerships, the emergence of more chief digital officers who manage across online and physical stores demonstrates that “retailers are striving to be more omnichannel.” As retailers move more of their center store to a digital platform, they must have a digital strategy that blends across all channels, DeGraeve adds.

The technology to enable retailers to offer added assortment and collaborate with fulfillment partners that can ship directly to the consumer’s home is getting better, in his opinion.

“Technology platforms enable integrating additional SKUs into a retailer’s offering,” he notes. “It’s attractive to retailers, because they don’t have the bandwidth to do this on their own; it’s a low-risk opportunity to bring added satisfaction to customers, and there’s some margin for the retailer.” An added bonus: The data belongs to the retailer and can help it shape in-store and online assortment.

One such fulfillment partner is Brooklyn, N.Y.-based L&R Distributors Inc., specializing in “longtail” nonfood items such as beauty and general merchandise, which are SKU-intensive and slow-moving. CEO Marc Bodner says that endless aisles, especially in-store endless aisles, are still so new that every retailer has its own strategy.

“Everyone is trying to figure it out,” he admits. “We want to help our retail customers capture or recapture sales that were leaving the physical store.”

Bodner continues, “We take the complexity out of endless aisle for retailers” by partnering with companies such as ItemMaster for content, and businesses like Locai, which integrates the retailer’s website with fulfillment.

Under the leadership of SVP of Digital Narayan Iyengar, Boise, Idaho-based Albertsons Cos. is approaching 2019 like an incubated technology startup, notes Jon Fahrner, head of Marketplace at the grocer: “By setting it up as a lean and fast-moving startup, we can do some things quickly that are beneficial to the entire organization and our shoppers, versus being part of a bigger department.

“Our high-level goal is to allow our millions of shoppers to get anything they want any way they prefer, and to have it show up as quickly as possible,” Fahrner adds. “Physical barriers will go away. We’ll extend our assortment through digital and in-store experiences.”

The company just launched its Digital Marketplace, but in store is not far behind. “We’re able to leverage the power of digital to serve our shoppers further with items we don’t carry in store,” he points out. “The endless aisle isn’t intended to conflict with the physical store, but to provide a bridge to things like artisan foods and natural and organic household items.”

Ahold Delhaize is experimenting with in-store kiosks throughout its concept store in Belgium, providing shoppers the ability to digitally tap into thousands of items for next-day delivery to home or the store. Store personnel are trained to encourage and help shoppers use the endless-aisle offering.

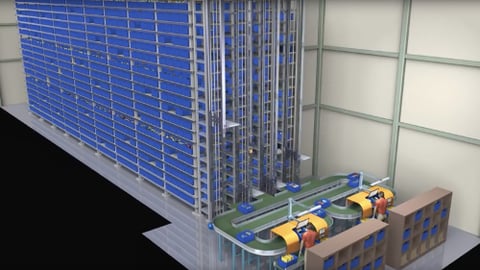

“Ahold Delhaize has intentionally put together warehouses of slower-moving products,” says Brick Meets Click’s Bishop. “The likelihood of losing control is much less.”

Locai’s DeGraeve thinks this model is the future. “More electronic stimulus will show up in the aisles to prompt shoppers to see what’s available,” he predicts. “[In-store kiosks or touchpads] will take longer for shoppers to migrate to than online, where there is already more familiarity for both retailer and shopper with endless aisles. But in the future, you’ll see more of what Ahold is offering.”

Just knowing that the service exists might be reason enough for shoppers to visit a store. Even if they can’t find what they’re looking for on the shelf, they’ll walk out knowing that they’ll have their items of choice delivered in good time.